Diving into the world of Anti-Money Laundering (AML) and Combating Terrorism Financing (CTF) can often feel like navigating a labyrinth of complex regulations and intricate procedures. However, the course, “Anti-Money Laundering and Combating Terrorism Financing“, offered by g-Log Consult, spearheaded by Samuel Aremu, promises to demystify these concepts in an engaging and accessible manner.

Right off the bat, the course’s ambitious goal to unravel the intricacies of money laundering and terrorism financing caught my attention. With no prerequisites required aside from an eagerness to learn, it seemed like the perfect opportunity for beginners like myself to dip our toes into the AML/CFT pool. The promise of learning about the consequences of money laundering, understanding KYC/CDD standards, and designing policies to safeguard businesses piqued my interest.

Instructor Reputation

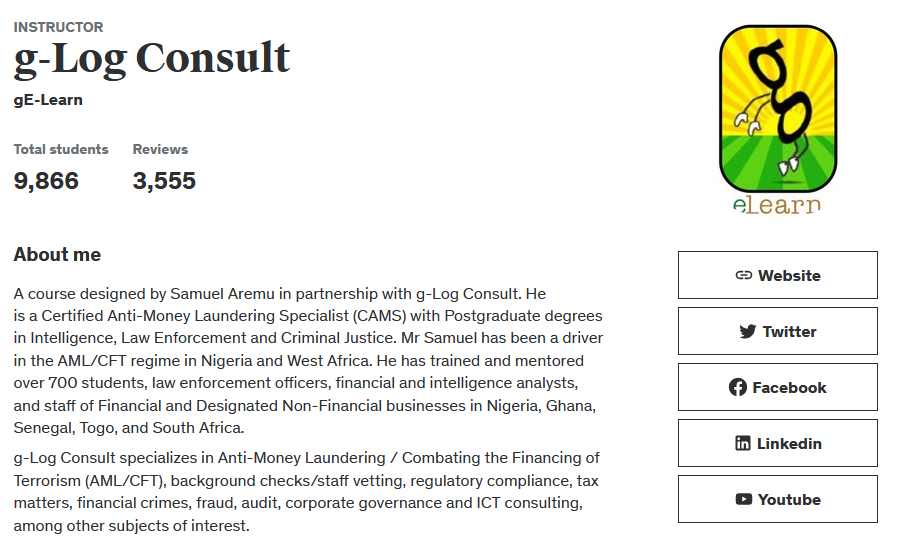

When it comes to learning about complex and nuanced topics like Anti-Money Laundering (AML) and Combating Terrorism Financing (CTF), the instructor’s reputation and background play a pivotal role in not just the delivery of content but also in how that content is absorbed and applied in real-world scenarios. Samuel Aremu, in partnership with g-Log Consult, stands as a towering figure in the landscape of AML/CFT education, bringing a wealth of knowledge, experience, and practical insights to the course.

Aremu’s credentials are nothing short of impressive. As a Certified Anti-Money Laundering Specialist (CAMS), he brings a level of expertise that is both broad and deep. His postgraduate degrees in Intelligence, Law Enforcement, and Criminal Justice provide a solid academic foundation, while his extensive field experience in Nigeria and across West Africa adds a layer of practical wisdom that cannot be gleaned from textbooks alone.

Over the years, Aremu has been a driving force in the AML/CFT regime, not just as an educator but also as a mentor and a pioneer. Having trained and mentored over 700 students, law enforcement officers, financial and intelligence analysts, and staff of Financial and Designated Non-Financial Businesses, his impact is widespread. His ability to distill complex regulations and procedures into digestible, actionable insights has made him a revered figure among professionals and novices alike.

Moreover, Aremu’s partnership with g-Log Consult, a consultancy specializing in AML/CFT, among other critical areas, ensures that the course is not just theoretical but grounded in the realities of today’s financial crime prevention efforts. g-Log Consult’s reputation for excellence in regulatory compliance, financial crimes, fraud, audit, and corporate governance further enhances the credibility and value of the course.

In essence, Samuel Aremu’s reputation is built on a solid foundation of academic excellence, field experience, and a genuine passion for educating others. His approachable teaching style, coupled with real-life examples and anecdotes, makes learning engaging and effective. For students of this course, learning from Aremu is not just an educational experience but a journey into the heart of AML/CFT, guided by one of the field’s most knowledgeable and respected figures.

Course Structure

The structure of the “Anti-Money Laundering and Combating Terrorism Financing” course is meticulously designed to cater to a wide range of learners, from novices to seasoned professionals in the financial sector. The course’s architecture is both its backbone and its roadmap, guiding learners through the complex world of AML/CFT with clarity and precision.

The course kicks off with an introduction to the basic concepts of money laundering and terrorism financing, setting the stage for a comprehensive exploration of the subject. This foundation is crucial for understanding the more complex topics that follow. The structure is intuitive, allowing learners to build their knowledge progressively, layer by layer.

One of the standout features of the course structure is its modular design. Each module focuses on a specific aspect of AML/CFT, from the history and mechanisms of money laundering to the intricacies of customer due diligence (CDD) and know your customer (KYC) policies. This modular approach makes the content manageable, allowing learners to digest information in bite-sized pieces and at their own pace.

Furthermore, the course is enriched with a variety of learning materials and activities. Video lectures form the core of the course, but they are complemented by quizzes, case studies, and assignments that reinforce learning and encourage application. The inclusion of subtitles in six languages broadens the course’s accessibility, making it a valuable resource for a global audience.

The course’s content is continuously updated to reflect the latest developments and trends in AML/CFT. For instance, the addition of a module on state capture and the enhanced focus on money laundering and terrorism financing keep the course relevant in a rapidly evolving field. These updates ensure that learners are not just learning static concepts but are also staying abreast of current challenges and solutions in the fight against financial crimes.

Another noteworthy aspect of the course structure is the inclusion of bonus resources, such as the Wolfsberg AML Principle on Political Exposed Persons (PEPs). These resources offer learners an opportunity to delve deeper into specific topics, enriching their learning experience and providing them with tools and knowledge that extend beyond the core curriculum.

In conclusion, the thoughtful and comprehensive structure of the “Anti-Money Laundering and Combating Terrorism Financing” course by g-Log Consult and Samuel Aremu makes it an exceptional learning experience. It strikes a perfect balance between theoretical knowledge and practical application, designed to equip learners with the skills and insights needed to navigate the complex world of AML/CFT with confidence.

Content Quality

The “Anti-Money Laundering and Combating Terrorism Financing” course offered by g-Log Consult, under the guidance of Samuel Aremu, shines brightly when it comes to the quality of its content. The course is a rich tapestry of meticulously curated information, designed to cater to a broad audience yet never compromising on depth and detail. The blend of theoretical underpinnings with practical applications sets this course apart, making it a beacon for those eager to delve into the complexities of AML/CFT.

The curriculum is comprehensive, covering a wide array of topics that are crucial for understanding the AML/CFT landscape. Starting from the basics of money laundering and terrorism financing, the course swiftly moves into more intricate subjects such as the principles of customer due diligence, the nuances of KYC/CDD strategies, and the critical aspects of risk identification and management. The content is not just about imparting knowledge; it’s about building a robust framework that learners can apply in real-world situations.

What enhances the content quality further is the way information is presented. The course uses a variety of formats to engage learners, from video lectures and interactive quizzes to in-depth case studies and assignments. This multi-modal approach caters to different learning styles, ensuring that all learners can grasp the material effectively. The video lectures are particularly noteworthy for their clarity and conciseness, breaking down complex concepts into understandable segments without oversimplifying them.

Moreover, the course’s content is regularly updated, reflecting the latest trends, laws, and methodologies in the AML/CFT domain. This commitment to currency and relevance is critical in a field that is constantly evolving in response to new challenges and regulatory changes. The inclusion of modules on state capture and the enhanced focus on digital data and information demonstrate the course’s alignment with contemporary issues in financial crime.

The bonus resources provided, such as the Wolfsberg AML Principles on Political Exposed Persons (PEPs), are a goldmine for learners looking to deepen their understanding. These additional materials serve not just as supplementary learning aids but as essential tools for those who wish to explore specific aspects of AML/CFT in greater detail.

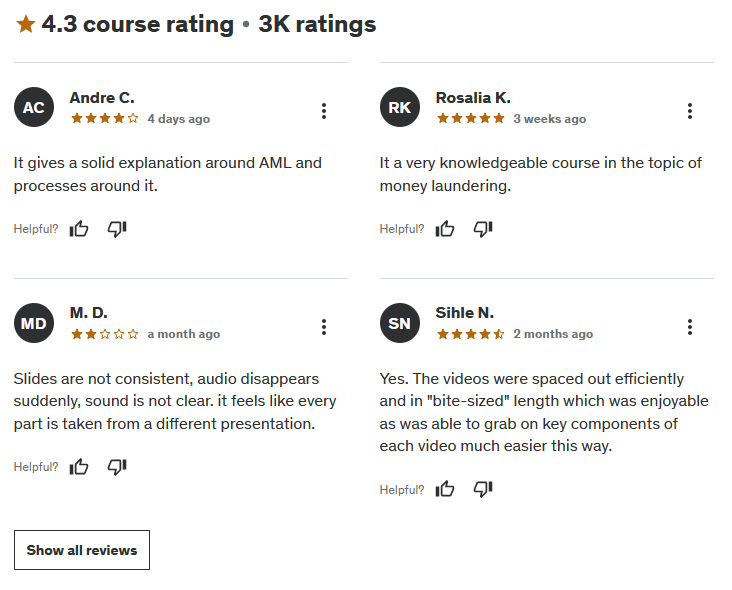

Overall Course Rating – 9/10

After thoroughly engaging with the course and evaluating its various aspects, I would confidently give the “Anti-Money Laundering and Combating Terrorism Financing” course by g-Log Consult and Samuel Aremu a solid 9 out of 10.

The course stands out for several reasons. The depth and breadth of the content covered are impressive, offering learners a comprehensive understanding of AML/CFT that is both broad and deep. The instructional quality provided by Samuel Aremu, coupled with his extensive experience and engaging teaching style, adds immense value to the learning experience. His ability to demystify complex topics and present them in an accessible manner is exceptional.

The course structure deserves special mention for its logical flow and modular design, making the learning journey smooth and coherent. The inclusion of quizzes, case studies, and assignments enhances the interactive aspect of the course, encouraging learners to apply what they’ve learned in practical scenarios.

The content’s quality, with its mix of theoretical insights and practical applications, is top-notch. The course’s commitment to staying updated with the latest developments in the field ensures that learners are getting information that is not only relevant but also cutting-edge.

However, there’s always room for improvement. While the course does an excellent job in many areas, expanding the range of interactive elements and perhaps incorporating more live sessions or forums for discussion could further enhance learner engagement and provide additional avenues for applying the knowledge gained.

In conclusion, the “Anti-Money Laundering and Combating Terrorism Financing” course is an outstanding resource for anyone looking to deepen their understanding of AML/CFT. Whether you’re a newcomer to the field or a seasoned professional seeking to update your knowledge, this course offers a wealth of information, insights, and practical strategies that are invaluable in today’s complex financial landscape. With its comprehensive content, expert instruction, and engaging delivery, it’s a course that truly stands out in the realm of financial crime education.