Let’s dive into the world of financial literacy with a course that promises not just to educate but to transform how you interact with your money. “Personal Financial Well-Being” by Richard Okumoto, offered through Dot University, is a beacon for anyone looking to navigate the often turbulent waters of personal finance. From the outset, this course distinguishes itself with a clear mission: to arm its students with the knowledge and tools necessary for financial prosperity and security.

Right from the get-go, “Personal Financial Well-Being” strikes a chord by addressing a glaring gap in our educational system: the lack of comprehensive financial education. It’s a course designed not just for the financially curious but for anyone who’s ever felt the sting of financial uncertainty. The promise is bold yet simple – to master personal financial well-being.

Instructor Reputation: The Pillar of Authority and Experience

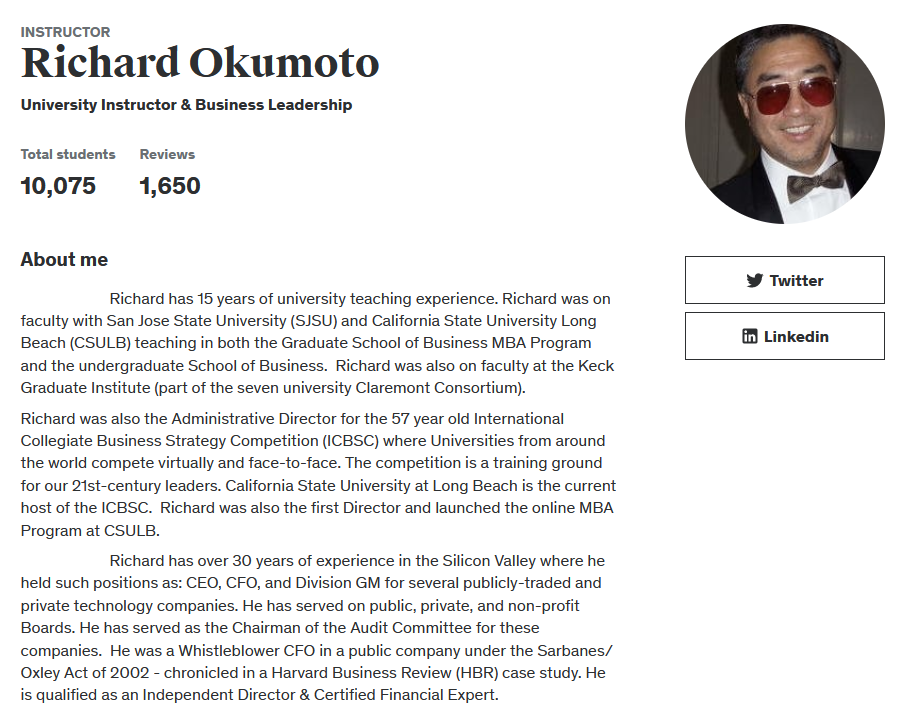

When delving into the realm of personal finance education, the instructor’s credentials and teaching prowess become the linchpin of the course’s credibility and effectiveness. Richard Okumoto stands as a towering figure in this context, offering a blend of real-world experience and academic insight that is both rare and invaluable. His multifaceted career spans over three decades in the high-stakes environment of Silicon Valley, where he has navigated the roles of CEO, CFO, and Division GM for various technology entities. This hands-on experience in the corporate world, managing finances at the highest level, provides him with a depth of knowledge and practical insights that are indispensable for anyone looking to master personal finance.

But Okumoto’s expertise isn’t confined to the boardroom. His academic credentials are equally impressive, with a teaching career that extends over 15 years at respected institutions such as San Jose State University (SJSU), California State University Long Beach (CSULB), and the Keck Graduate Institute, part of the Claremont Consortium. This blend of practical and theoretical knowledge is a hallmark of his teaching style, enabling him to convey complex financial concepts in a manner that is both understandable and relatable. His work as the Administrative Director for the International Collegiate Business Strategy Competition further underscores his commitment to shaping future leaders, emphasizing not just the importance of financial acumen but also the ethical considerations that accompany it.

Okumoto’s approach to teaching personal finance is underpinned by his own academic achievements, including a BS Degree in Accounting, an MA in Communications, and a Ph.D. in Information Science. These qualifications, combined with his Personal Financial Planning Registered Financial Consultant designation, position him as a formidable instructor who is not just teaching from a textbook but from a life rich with diverse financial experiences.

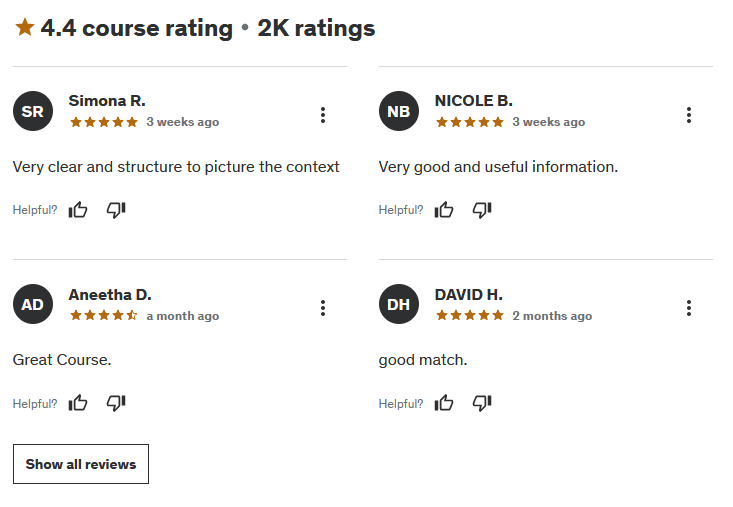

His instructor rating of 4.4, based on feedback from 1,650 reviews, is a testament to his ability to connect with students and impart wisdom in a way that is both engaging and enlightening. Students frequently cite his clear explanations, practical examples, and the relatable way he demystifies complex financial topics. This level of engagement and satisfaction among learners is indicative of Okumoto’s skill in not just transmitting information, but in truly teaching – fostering understanding, curiosity, and confidence in his students.

Course Structure: A Masterfully Crafted Journey Through Finance

The “Personal Financial Well-Being” course is a testament to Richard Okumoto’s deep understanding of personal finance and his commitment to student success. It is meticulously structured to guide learners through the intricacies of financial management in a logical, comprehensive manner. The course is divided into three core building blocks: Generating Positive Cash Flow, Accumulating Wealth, and Protecting What You Have. This tripartite framework is ingeniously designed to cover the full spectrum of personal finance, from the fundamentals of budgeting and debt management to the more complex realms of investing and estate planning.

The first block, Generating Positive Cash Flow, serves as the foundation of the course. It addresses the critical aspect of understanding and managing one’s money to enhance financial stability. Topics such as personal budgeting, debt management, understanding personal income taxes, and the basics of retirement planning are covered in depth. This section is vital for establishing a strong financial footing, emphasizing the importance of living within one’s means while planning for future needs.

The second block, Accumulating Wealth, shifts the focus towards growth and expansion. Here, learners explore the concepts of wealth determination, basic and advanced investing, and the nuances of comprehensive retirement planning. This section is designed to equip students with the tools and knowledge necessary to not just manage their finances, but to actively grow and diversify their wealth over time. The emphasis is on strategic investment practices, understanding market dynamics, and leveraging financial instruments to build a robust financial portfolio.

The final block, Protecting What You Have, addresses the often overlooked aspect of financial planning: risk management. Topics such as insurance and estate planning are covered, highlighting the importance of safeguarding one’s assets against unforeseen circumstances. This section underscores the reality that financial well-being is not just about accumulation but also about preservation. It teaches students how to create a comprehensive financial plan that includes protective measures to ensure long-term stability and peace of mind.

Throughout the course, Okumoto utilizes a combination of theoretical explanations, practical exercises, and real-world examples to facilitate a deep understanding of each topic. The course’s structure is not just about imparting knowledge; it’s about building a framework within which students can make informed financial decisions and develop strategies that are tailored to their individual goals and circumstances. This thoughtful, comprehensive approach to course design is what sets “Personal Financial Well-Being” apart as a premier learning experience in personal finance.

Content Quality: A Beacon of Clarity in the Financial Fog

The “Personal Financial Well-Being” course is a masterclass in content quality, setting a benchmark for educational material that is not only informative but also engaging and accessible. Each module within the course is meticulously crafted to ensure that complex financial concepts are broken down into understandable segments that resonate with learners of all levels. The course stands out for its practicality, offering a blend of theoretical knowledge underpinned by real-world applications that bridge the gap between learning and living.

Richard Okumoto’s approach to content delivery is exemplary. He leverages a variety of teaching tools, including animated charts, visual aids, and concise bullet points, to highlight key information and ensure it sticks. This visual and animated approach not only makes the learning process more enjoyable but also enhances retention by catering to different learning styles. The content is segmented into short, manageable sections, making it easy for students to progress at their own pace without feeling overwhelmed.

Beyond the presentation, the quality of the content itself is noteworthy. The course covers an extensive range of topics, from the basics of personal budgeting and debt management to the complexities of retirement planning and estate preparation. Each topic is presented with depth and precision, offering students a comprehensive understanding of personal finance. Okumoto’s expertise shines through in the nuanced discussions of each subject, where he not only teaches the “how” but also delves into the “why,” providing a holistic view of financial management.

Feedback from students underscores the value of the course’s content. Many express appreciation for the practical tips and actionable strategies that can be immediately applied to their financial lives. The inclusion of exercises and real-life examples further enriches the learning experience, enabling students to see the direct impact of financial principles in everyday scenarios. This practical application of theory to reality is a cornerstone of the course’s content quality, making complex financial concepts approachable and understandable.

Overall Course Rating: A Comprehensive Financial Mastery Journey (9/10)

After a thorough review of “Personal Financial Well-Being“, including its structure, content quality, and student feedback, the course merits a distinguished rating of 9 out of 10. This high score reflects the course’s exceptional ability to demystify the complex world of personal finance, making it accessible and actionable for a broad audience.

The course’s strengths are manifold. Richard Okumoto’s expertise and engaging teaching style form the bedrock of this learning experience, providing students with a trustworthy guide through the intricacies of financial planning. The course’s structured approach, dividing the vast subject of personal finance into three digestible building blocks, ensures that learners gain a comprehensive understanding of financial well-being. Each section builds upon the last, creating a cohesive and comprehensive curriculum that equips students with the knowledge and tools to manage, grow, and protect their wealth.

The quality of the course content is another highlight, with its blend of theoretical depth and practical application. The use of visual aids and concise, impactful explanations helps to cement understanding and retention of financial concepts. Student testimonials further attest to the course’s effectiveness, praising its organization, clarity, and the practical value of the lessons learned.

However, no course is without room for improvement. A more interactive component, such as live Q&A sessions or discussion forums, could enhance the learning experience by providing students with the opportunity to engage directly with the instructor and peers. Such interactive elements could foster a more dynamic learning environment and allow for real-time clarification of doubts and sharing of experiences.

In conclusion, this stands out as a premier course for anyone looking to gain mastery over their financial situation. With its expert instructor, well-structured content, and practical insights, it offers a comprehensive toolkit for achieving financial well-being. Whether you’re a beginner looking to lay a solid financial foundation or someone with more experience seeking to expand your knowledge, this course provides valuable lessons that can make a significant impact on your financial journey.