If you’ve been watching the crypto markets from the sidelines or dabbling with trades that feel more like educated guesses than confident moves, this new Udemy course might be exactly what you need. “Bitcoin & Crypto Trading: Master Financial Analysis” is a comprehensive trading course designed to help you decode the crypto market, analyze patterns like a pro, and—most importantly—trade profitably.

Whether you’re into scalping quick profits or riding long swings, this course covers it all. Let’s break it down.

Instructor Reputation

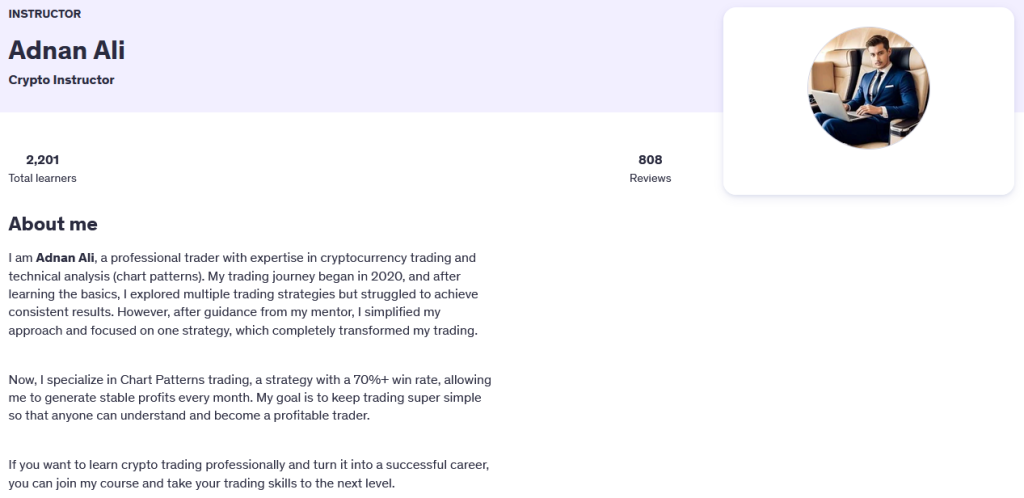

Adnan Ali might be a new face on Udemy with just one course under his belt, but don’t let that fool you—he brings a focused, deeply practical approach to crypto trading that stands out in a crowded market. His personal story is one that many aspiring traders will relate to: starting with a curiosity about cryptocurrency, diving into various strategies, hitting walls, and then finally finding success through disciplined simplicity. It’s this journey that gives his teaching real weight.

Adnan doesn’t claim to be a Wall Street veteran or a Silicon Valley crypto tycoon. Instead, he positions himself as someone who has been in the trenches—testing, failing, learning, and ultimately refining a method that works. His core trading strategy, which revolves around chart pattern recognition, is based on a 70%+ win rate. That number might raise eyebrows at first, but when you go through the course, you realize he’s not exaggerating. He’s just extremely precise in what he teaches—and he sticks to what he knows best.

What really sets Adnan apart is his ability to explain complex trading concepts without overwhelming beginners. His teaching style is calm, focused, and direct. There’s no fluff, no hype, and no clickbait promises. Instead, he emphasizes mindset, discipline, and clear technical setups. He also spends time on the psychology behind trading decisions, something many instructors gloss over. Understanding why you’re making a trade and how to handle your emotions is a central theme in his lessons.

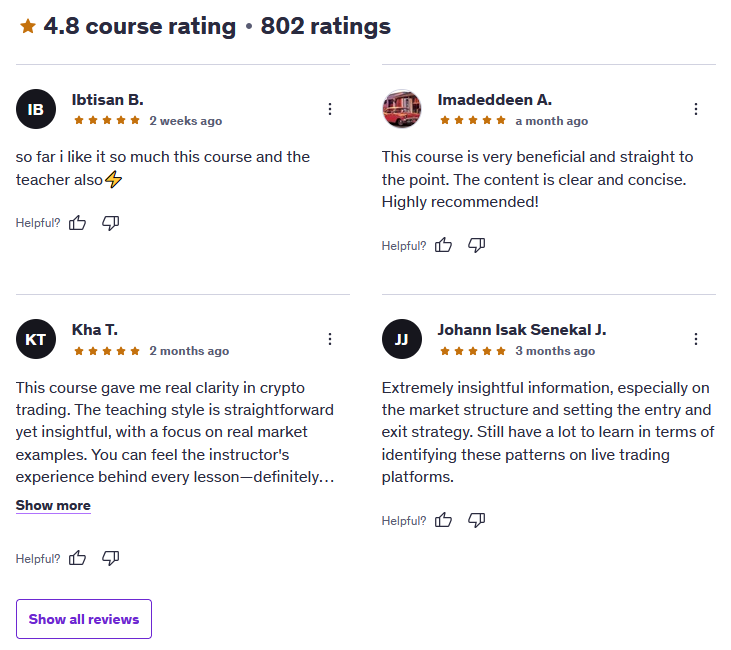

Looking at student feedback, the sentiment is overwhelmingly positive. Many praise his clarity, structure, and use of real market examples, saying that the course gave them more confidence in reading charts and executing trades. A few learners wished for more interactive elements or quizzes, but nearly all agree that the depth of insight offered is more than enough to justify the course’s value.

Despite having just over 2,000 students enrolled, Adnan’s 4.8-star rating across more than 800 reviews shows that he’s doing something right. If he continues to deliver content with the same clarity and hands-on relevance, there’s no doubt he’ll become a standout name in the Udemy trading education space.

Course Structure

“Bitcoin & Crypto Trading: Master Financial Analysis” is not your average “crypto for beginners” course. It’s a well-crafted, in-depth learning journey that takes you from basic concepts all the way to advanced trading setups—with a strong focus on technical analysis and real market application.

The structure follows a logical progression, starting with the fundamentals of chart reading, including support and resistance levels, trendlines, and candlestick formations. From there, the course builds into more complex strategies like identifying order blocks, using premium and discount zones, and recognizing trend versus range-based markets. Each concept is explained with clarity, reinforced by live chart examples that show you exactly how to apply the knowledge in real-world trading scenarios.

Here’s a breakdown of how the course is organized:

- Foundation Modules: These cover essential topics like chart patterns (Head & Shoulders, Double Tops, Triangles), candlestick analysis, and market structure. This part of the course is designed to build your “trading vocabulary” so that everything that follows makes intuitive sense.

- Technical Mastery: Once you have the basics down, the course dives into more technical tools—RSI, MACD, Bollinger Bands, oscillators, and channels. Adnan doesn’t just tell you what these indicators are—he shows you how to interpret them in combination with market structure to time entries and exits.

- Trading Styles & Timeframes: You’ll learn how to adjust your analysis based on whether you’re scalping, day trading, swing trading, or taking longer positions. This part is extremely helpful for traders who are still figuring out what style fits them best.

- Risk Management & Strategy: Adnan places a strong emphasis on risk—to-reward ratios, stop-loss placement, and position sizing. He teaches you how to protect your capital while still staying aggressive enough to grow your account. These lessons are especially valuable because they come from lived experience, not just textbook theory.

- Trading Psychology: This section is a standout. Instead of treating psychology like a side note, it’s baked into the overall learning path. Adnan walks through common emotional pitfalls, like FOMO, revenge trading, and fear-based exits, and gives you tools to stay disciplined—even in volatile conditions.

- Live Chart Demonstrations: Perhaps the most impactful part of the course is the frequent use of live market examples. These aren’t just screenshots—Adnan walks you through actual setups and shows how patterns unfold in real-time. It’s like having a mentor sitting next to you explaining every decision step by step.

The course is also very flexible. It’s designed to support multiple learning styles—you can move through the modules in order or revisit specific sections as needed. Everything is broken into bite-sized videos, which makes it easy to digest, especially if you’re learning during a busy schedule.

While the course doesn’t have a lot of interactive assignments or quizzes, the real value comes from repetition and live market practice, which Adnan encourages throughout. If you’re willing to spend time replaying the lessons and applying them using tools like TradingView, you’ll walk away with a solid trading framework.

Content Quality

The content quality in Bitcoin & Crypto Trading: Master Financial Analysis is impressive—especially when you consider how easily a crypto trading course can go off the rails into hype, theory-heavy rambling, or overly simplified tutorials. Adnan Ali strikes a careful and commendable balance here, delivering material that’s both in-depth and highly applicable to real-world trading scenarios.

One of the biggest strengths of this course is how dense it is with actionable insights, yet it never feels overwhelming. Each module focuses on a clear trading concept—whether it’s identifying a Double Top, drawing trendlines, or reading RSI signals—and builds upon previous lessons in a way that feels intentional and well-paced. The result is a curriculum that slowly strengthens your chart-reading skills while teaching you how to execute strategies with increasing confidence.

The technical analysis section in particular is standout. Adnan doesn’t just explain what a pattern looks like—he explains why it forms, how it interacts with market psychology, and when it’s most likely to succeed or fail. For example, the section on support and resistance levels goes beyond simply identifying price zones. It delves into how these zones relate to emotional decision-making in the market, and how traders can time their entries and exits based on how price behaves near these levels. This level of nuance is rare in beginner-to-intermediate trading courses and reflects Adnan’s real-world experience.

Another highlight is the candlestick analysis module. Too often, courses treat candlestick patterns as static textbook entries—Adnan, on the other hand, frames them as part of an evolving narrative in market movement. You’re taught to read the story the candles are telling, rather than just memorizing names like “engulfing” or “doji.”

What also elevates the content is the emphasis on psychological resilience. Adnan takes the time to teach you how to recognize the emotional traps that traders fall into: fear, greed, overtrading, revenge trading, hesitation. He discusses how those emotions tie back to chart patterns, risk management, and even timeframes. These mindset modules aren’t just an afterthought—they’re integrated into the technical lessons and reinforced throughout the course.

The course also includes real-time market demonstrations using TradingView, which greatly helps in bridging the gap between theory and practice. Students can watch him break down live setups, explain why he’s entering or avoiding a trade, and how he uses multiple indicators to confirm a decision. These live examples create a kind of “learning by osmosis” experience where even the subtleties of chart behavior become clearer over time.

If there’s one minor area where the content could improve, it would be the inclusion of more interactive elements—perhaps worksheets, quizzes, or chart-based challenges to test comprehension. Still, the high replay value of the videos and the encouragement to practice with real charts more than makes up for it.

Overall Course Rating – 9.1/10

“Bitcoin & Crypto Trading: Master Financial Analysis” earns a well-deserved 9.1 out of 10 for its thoughtful structure, depth of content, and the instructor’s commitment to teaching practical, psychology-informed strategies that are grounded in real market behavior.

Right from the start, you get the sense that this course is different from the flashy, over-promising trading tutorials that flood the internet. Adnan Ali’s teaching is focused and sincere—he doesn’t sugarcoat the realities of trading, nor does he overwhelm you with jargon. Instead, he builds up your knowledge piece by piece, guiding you through technical analysis, risk management, and emotional discipline in a way that feels comprehensive without being exhausting.

The course is especially strong in its approach to technical analysis and market structure. Instead of being a copy-paste walkthrough of chart patterns and indicators, Adnan teaches you to think like a trader—how to assess context, understand trend behavior, and weigh probabilities before taking a position. These skills are essential for long-term success, and few instructors explain them with such clarity.

Another reason the course scores high is its broad appeal across skill levels. Beginners will appreciate the early foundational lessons and slow, clear pace. More experienced traders will still find value in the breakdowns of advanced tools like Bollinger Bands, order blocks, and premium/discount zones. Regardless of where you’re starting from, there’s room to grow.

Perhaps most notably, the course doesn’t shy away from the psychological side of trading, which is often the biggest difference-maker between profitable and losing traders. By emphasizing discipline, mindset, and emotional control, Adnan ensures that you’re not just equipped with strategies, but with the mental framework to apply them consistently.

The only reason this course doesn’t hit a perfect 10 is the lack of built-in interactive tools like downloadable exercises or live trade simulations. Including those would make it more hands-on and cater to kinesthetic learners. However, if you’re willing to put in the practice using live charts alongside the videos (as the course encourages), you’ll still walk away with a robust, market-ready skill set.

Final verdict? Whether you’re brand new to trading or looking to sharpen your edge with better chart analysis and emotional control, this course delivers real value. It’s practical, well-paced, and packed with tools that can help turn trading from a frustrating guessing game into a confident, structured process.