If you’ve ever wondered how insurance actually works or why companies spend so much effort thinking about risk, Fundamentals of Insurance – 1 might be the perfect place to start. This course is designed for absolute beginners and breaks down complex insurance concepts into easy-to-follow lessons. Whether you’re considering a career in insurance or just want to understand the basics, it lays down a solid foundation without overwhelming jargon.

Instructor Reputation

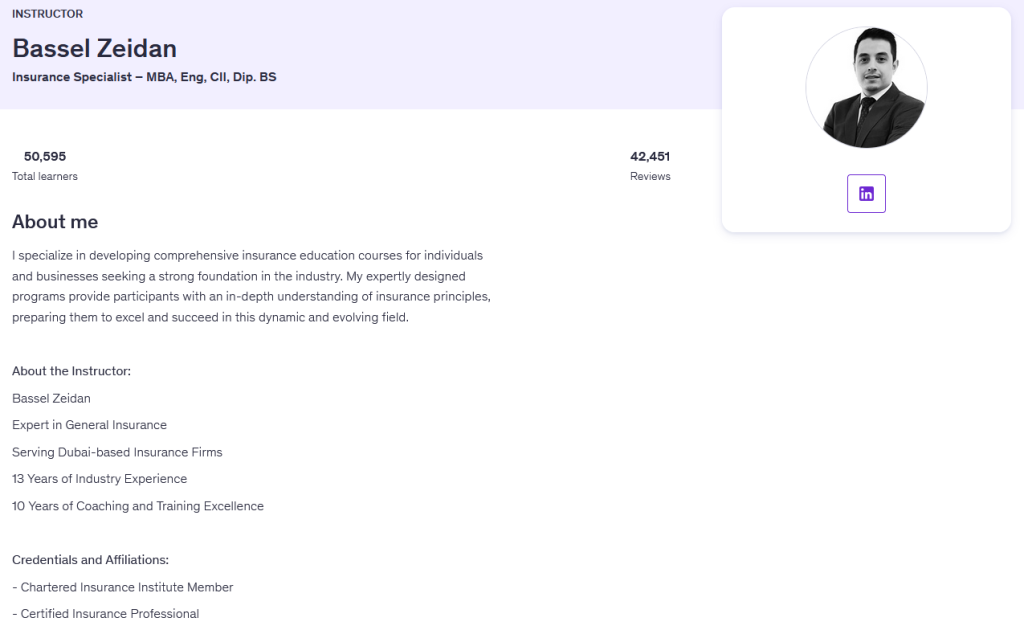

When you’re taking a professional course, the instructor’s background can make or break the experience. In this case, Bassel Zeidan brings a lot to the table. With over 13 years working in general insurance for Dubai-based companies, he’s not just teaching from textbooks—he’s sharing what actually happens in the field. That kind of first-hand perspective is really valuable, especially in an industry where theory and practice don’t always line up perfectly.

What’s equally impressive is his track record as a trainer and coach. Bassel has been teaching for about 10 years, which means he knows how to break down complicated concepts into manageable pieces. Insurance can get pretty technical—things like risk classifications, insurability factors, and the fine details of contracts aren’t exactly light reading—but his style makes these topics approachable. Students often comment that his pacing may feel slow at first, but that’s intentional. He takes time to make sure learners really absorb the fundamentals, which pays off when concepts start building on each other later in the course.

On top of his experience, Bassel’s credentials speak for themselves. He’s a member of the Chartered Insurance Institute (CII), a respected professional body in the insurance world. Being part of CII signals a commitment to professional standards and continuous learning. Add to that his certification as an insurance professional, and you’ve got someone who not only knows the theory but is officially recognized for his expertise.

From a student’s perspective, it’s also reassuring to see his overall teaching reputation on Udemy. With more than 50,000 students enrolled in his courses and 42,000+ reviews averaging around 4.5 stars, he’s clearly doing something right. That level of consistency suggests he’s reliable, responsive, and effective as an instructor. All in all, Bassel brings the right mix of professional credibility, teaching experience, and student satisfaction to make this course worth your time.

Course Structure

The way a course is structured often determines how easy (or hard) it is to follow along, and Fundamentals of Insurance – 1 is thoughtfully put together. The course doesn’t just throw jargon at you and hope it sticks; it’s laid out step by step, building your knowledge in a logical flow.

The journey starts with the concept of risk—what it is, how we perceive it, and how we respond to it. This foundation is important because understanding risk is at the core of why insurance even exists. From there, you move into risk management, where Bassel explains how businesses and individuals make decisions to minimize or transfer risks. This section connects theory to practice, showing how companies actually use these principles in day-to-day operations.

Next, the course dives into risk classification and insurability. This is where you learn how insurance companies decide what types of risks they’re willing to cover and under what conditions. It’s not just an academic exercise; it’s the backbone of how premiums are set and policies are written. Bassel gives examples that make it easier to see how this plays out in real-world scenarios.

Finally, the course wraps up with the principles of insurance. This is arguably the most important part, because these principles—like indemnity, utmost good faith, and contribution—are what guide how insurance contracts are written, interpreted, and enforced. Knowing them gives you a clear understanding of why policies are structured the way they are and why certain rules exist in the industry.

What makes the structure work so well is that it’s paced for beginners. There are no assumptions about prior knowledge, so each concept is introduced clearly before moving on to the next. By the end, you don’t just know definitions—you understand how all the pieces fit together in practice. Since this is only Part 1 of the series, the course also sets you up for more advanced topics in later installments, but you finish this section with a strong grasp of the basics.

In short, the structure is deliberate, practical, and very much geared toward making sure learners walk away with a usable understanding of insurance—not just a pile of terms to memorize.

Content Quality

The content of Fundamentals of Insurance – Part 1 is what really makes it stand out as a beginner’s course. Insurance is one of those fields that can seem dense and intimidating from the outside, but this course manages to make it accessible without watering it down. The lessons flow logically, and each section connects back to the big picture of how insurance works in practice.

One of the strengths of the course is its emphasis on clarity. Instead of bombarding you with heavy legal language or industry-only terms, Bassel explains concepts in plain English first and then layers on the proper terminology. For example, when he introduces the idea of risk, he doesn’t just define it—he shows you how we all face risk in our daily lives and how companies respond to it in structured ways. That real-life anchoring makes abstract topics much easier to absorb.

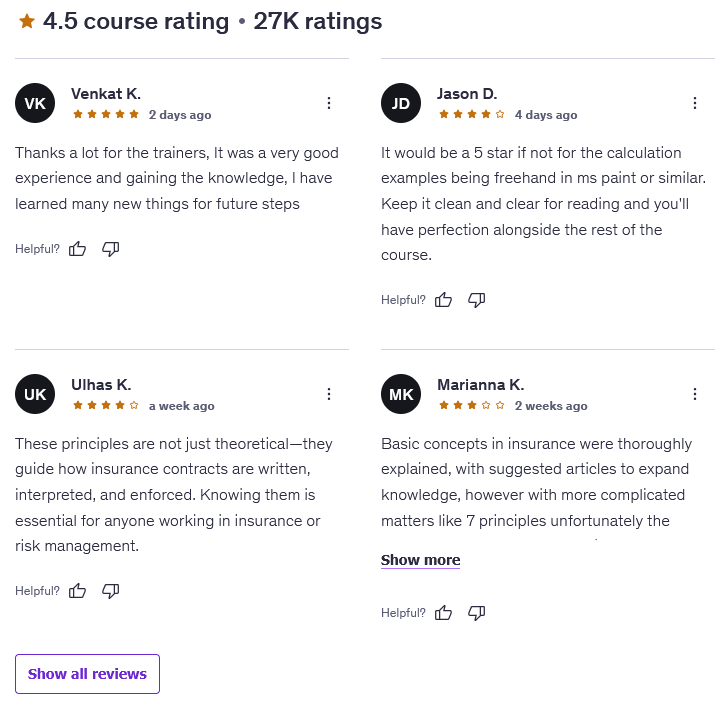

Students who took the course have pointed out that the pace is deliberately slow at the start, which might feel like a drawback if you’re hoping to speed through. But the benefit is that by the time you reach the sections on risk management or insurance principles, you already have a solid foundation. This steady build-up is particularly valuable for learners who have no prior exposure to insurance.

That said, the content isn’t perfect. A recurring piece of feedback is that the visuals—particularly the calculation examples—could use some polishing. Right now, they’re handwritten or drawn freehand in simple programs like MS Paint, which makes them a little rough around the edges. While this doesn’t ruin the learning experience, it does stand out compared to the otherwise well-structured delivery. Cleaner diagrams or slides would add more professionalism and make the material easier to reference later.

On the plus side, the real-world relevance of the lessons is a major highlight. The principles taught aren’t just academic—they show up in actual insurance contracts, risk assessments, and client interactions. Multiple students noted how the knowledge they gained was directly useful for their work or career aspirations. It’s this mix of theory and practice that makes the content worth your time. Overall, you walk away not just memorizing insurance terms, but understanding why they matter.

Overall Course Rating – 8.5/10

I’d give Fundamentals of Insurance – 1 a strong 8.5 out of 10. That number feels right because the course nails its core mission: making insurance understandable for complete beginners while still providing enough depth to be useful for professionals who want to strengthen their foundation.

The strengths of the course are clear: a knowledgeable instructor with real-world experience, content that’s carefully structured to build your understanding step by step, and a focus on connecting theory to practice. For someone completely new to the field, this is exactly the kind of approach that keeps you from getting lost in the weeds. It also helps that Bassel has a teaching style that’s patient and thorough—he doesn’t rush you through the material, and that makes it easier to grasp concepts that could otherwise feel overwhelming.

The downsides are relatively minor, but they’re worth noting. The biggest one is the presentation quality of visuals, which some students found distracting. While the explanations themselves are clear, the freehand diagrams don’t quite match the professionalism of the rest of the course. A little polish in this area could easily bump the rating higher. Another minor point is the pacing—if you’re the type of learner who prefers a brisker pace, you might find the early lessons slower than expected.

Overall, though, the positives far outweigh the negatives. Students consistently walk away feeling more confident in their understanding of insurance, and many note that it gave them a real leg-up in their careers. Whether you’re a student, job seeker, or professional looking to sharpen your basics, this course delivers what it promises: a solid, practical introduction to the world of insurance.