Jumping into the world of commercial credit can feel like navigating a dense jungle without a map. That’s where the “Intro to Commercial Credit Analysis, Credit Risk and Lending” course on Udemy comes into play, offering a machete of knowledge to clear the path ahead. Here’s my take on it, broken down by the outlined criteria.

First impressions? The course promises a deep dive into the intricacies of commercial credit analysis, credit risk identification, analysis, mitigation, and more. It’s designed for those looking to sharpen their finance skills, whether you’re a new relationship manager in banking or an analyst looking to broaden your understanding. The mix of financial analysis, risk assessment, and practical tools like the BCG Matrix and SWOT analysis, promises a comprehensive learning experience.

Instructor Reputation: A Deeper Dive

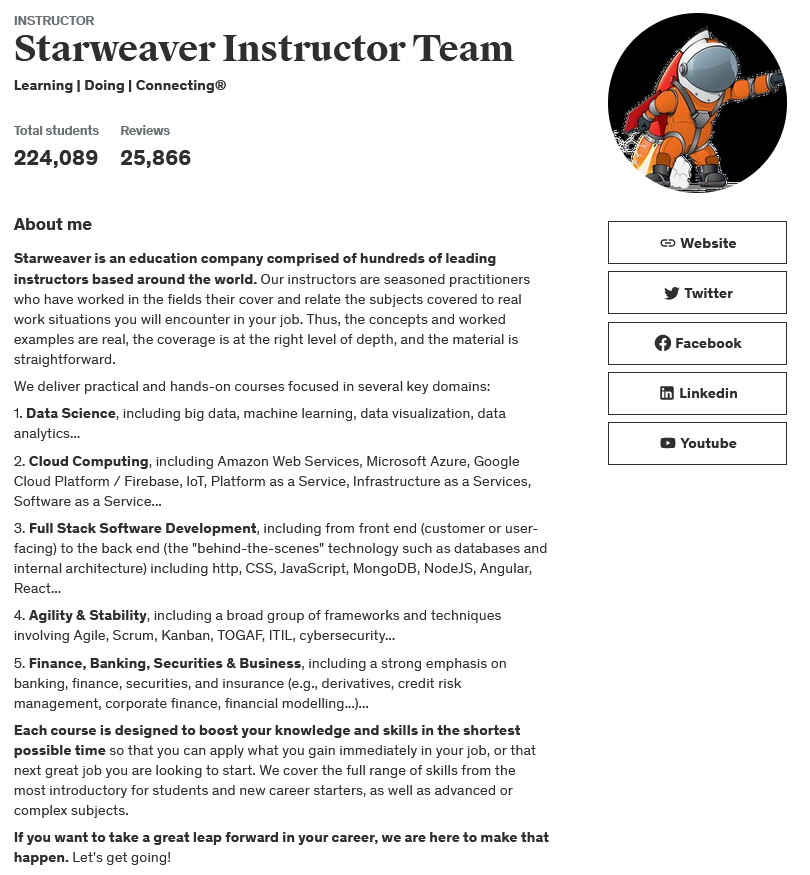

When choosing a course, especially one as nuanced and complex as commercial credit analysis, the instructor’s credibility and experience play a pivotal role in ensuring the value and applicability of the learning material. In the case of the “Intro to Commercial Credit Analysis, Credit Risk, and Lending” course offered on Udemy, the teaching baton is held by the Starweaver Instructor Team. This isn’t just any group of educators; it’s a battalion of seasoned professionals, each with a rich background in the commercial and corporate credit industry.

At the helm of this course is a team with an impressive 4.4 instructor rating, supported by a staggering 25,866 reviews and a student base of 224,089 learners across 21 courses. These numbers aren’t just for show. They reflect a consistent track record of delivering quality education, a testament to the team’s ability to distill complex financial concepts into digestible, relatable lessons that resonate with a wide audience. But what truly sets the Starweaver Instructor Team apart is their hands-on experience. They’re not just academics; they’re practitioners who’ve been in the trenches, grappling with the realities of commercial credit analysis and risk assessment. This real-world expertise enriches the course, infusing each lesson with practical insights that transcend textbook theory.

Moreover, Starweaver’s commitment to education is evident in their pedagogical approach. They focus on “Learning | Doing | Connecting®,” a mantra that encapsulates their method of interactive and applied learning. This isn’t about passive absorption of information; it’s an active engagement with the material, encouraging students to apply what they learn in practical scenarios, thereby enhancing retention and understanding.

The diversity of the Starweaver Instructor Team also plays a crucial role in the course’s appeal. With instructors drawn from a global pool of experts, students are exposed to a wide range of perspectives and practices in commercial credit analysis. This diversity enriches the learning experience, offering insights into how commercial credit is approached in different markets and under varying regulatory environments.

In summary, the instructor reputation of this course is not just built on a foundation of extensive experience and a broad student base but also on the quality, applicability, and engagement of the teaching. For learners embarking on this course, the Starweaver Instructor Team offers not just lessons but a gateway to understanding commercial credit analysis through the lens of seasoned professionals.

Course Structure: A Comprehensive Overview

Diving into the “Intro to Commercial Credit Analysis, Credit Risk and Lending” course, one is immediately struck by its meticulously designed structure, which is both comprehensive and engaging. Spanning 42 lectures across 8 sections, the course is ingeniously mapped out to guide learners from foundational concepts to more advanced topics in a coherent and logical sequence. This structured approach ensures that participants build their knowledge base gradually, laying a solid foundation before advancing to complex analyses and assessments.

The course kicks off with an introduction to the basics of commercial credit analysis, setting the stage for a deep dive into the process of risk identification, analysis, and mitigation. This foundational section is crucial for establishing a common understanding, ensuring that all learners, regardless of their prior experience, start on the same page. From there, the course swiftly moves into more specialized topics, including business, financial, and structural risk analyses, demonstrating how to apply finance skills effectively in these areas.

One of the standout features of the course structure is its focus on applying practical tools and frameworks, such as the BCG Matrix and Porter’s 5 Competitive Forces. These tools are not just mentioned in passing but are explored in depth, with dedicated lectures that include examples of their application. This emphasis on practicality is further evident in the sections dedicated to analyzing a company’s key financial statements and conducting SWOT analysis, offering learners hands-on experience in assessing the creditworthiness of borrowers.

Another commendable aspect of the course’s structure is its segmentation into specific areas of risk analysis, from macro to industry to company-specific levels. This tiered approach allows learners to grasp the complexities of risk assessment in a structured manner, appreciating the nuances that differentiate each level of analysis. Moreover, the course includes segments on determining appropriate credit risk categories and recommending credit decisions, rounding out the learner’s skill set in making informed lending decisions.

Each section of the course is carefully designed to not only impart knowledge but also to engage learners in the process of discovery and application. The use of examples throughout the course reinforces the theoretical concepts, bridging the gap between theory and practice. Furthermore, the logical progression from basic to advanced topics ensures that learners are continually building on their knowledge, avoiding any disjointed learning experiences.

In essence, the course structure is a thoughtfully crafted journey through the world of commercial credit analysis. It’s a path that takes learners from the foundational principles all the way to advanced techniques and decision-making processes, all the while ensuring engagement, practical application, and a deep understanding of the subject matter. For those seeking to master commercial credit analysis, this course offers a road map to success, designed with clarity, depth, and a focus on real-world applicability.

Content Quality: An In-depth Analysis

The “Intro to Commercial Credit Analysis, Credit Risk, and Lending” course on Udemy presents itself as a rich tapestry of content that meticulously covers every facet of commercial credit analysis. The quality of this content is not merely in its comprehensive coverage but in the depth and relevance of the material presented. Each lecture is carefully crafted to not only impart knowledge but also to stimulate critical thinking and application.

The course content excels in several key areas. First, it provides a solid grounding in the process of credit analysis, starting from risk identification through to analysis and mitigation. This foundational knowledge is crucial for anyone venturing into the field of commercial credit, ensuring learners have a strong base upon which to build their skills. Furthermore, the course delves into the application of finance skills in analyzing business, financial, and structural risks. This practical aspect of the course is one of its standout features, as it allows learners to apply theoretical knowledge in real-world scenarios.

Another significant strength of the course content is its focus on practical tools and frameworks, such as the BCG Matrix and Porter’s 5 Forces. These tools are not only explained in theory but are also demonstrated through practical examples, showing learners how to apply these concepts in actual credit analysis scenarios. This approach enhances the learning experience, making the content not just informative but also highly applicable.

Moreover, the course does an excellent job in covering the analysis of a company’s key financial statements, including income statements and balance sheets. This section is particularly valuable as it equips learners with the skills to dig into financial statements and assess a borrower’s creditworthiness. The inclusion of financial statement analysis is a testament to the course’s commitment to providing a well-rounded education in commercial credit analysis.

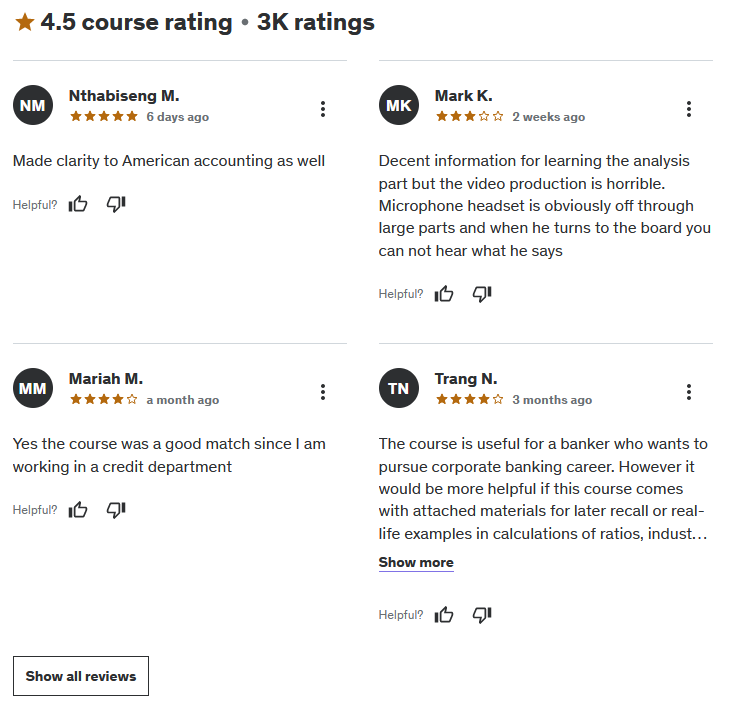

However, despite the high quality of the content, there is room for improvement. Feedback from learners suggests a desire for more real-life examples and case studies, especially in the application of ratios, industry analysis, and projections. Incorporating more of these examples could enhance the learning experience by demonstrating how the knowledge applies in real-world settings.

Overall Course Rating: 8.5/10

After thoroughly reviewing the “Intro to Commercial Credit Analysis, Credit Risk and Lending” course, considering its structure, content quality, and instructor reputation, I assign it an overall rating of 8.5 out of 10.

This rating reflects the course’s strengths, particularly its comprehensive coverage of commercial credit analysis topics, the depth of the content, and the practical, hands-on approach to learning. The instructors’ expertise and the structured layout of the course contribute significantly to its effectiveness as a learning tool for those new to commercial credit analysis or looking to deepen their understanding.

The practical applications of theoretical concepts, through the use of tools like the BCG Matrix and Porter’s 5 Forces, stand out as highlights of the course. These elements ensure that learners are not just passive recipients of information but active participants in their learning journey, applying what they learn in practical scenarios.

However, the course does not reach a perfect score due to the noted areas for improvement. Incorporating more real-life examples, detailed case studies, and perhaps additional downloadable resources for offline study could elevate the course to a perfect rating. These enhancements would address the feedback from learners seeking more application of knowledge in real-world contexts, thereby improving the overall learning experience.

In conclusion, the “Intro to Commercial Credit Analysis, Credit Risk, and Lending” course is a robust educational tool for anyone looking to enter or advance in the field of commercial credit analysis. Its strengths far outweigh its areas for improvement, making it a valuable investment for professionals seeking to enhance their skills in this domain. With a few adjustments and additions, this course could easily become the gold standard for commercial credit analysis training.