If you’ve ever found yourself staring at a stock chart wondering what all those lines and candlesticks mean—or if you’ve dreamed about jumping into the markets but didn’t know where to begin—The Complete Foundation Stock Trading Course might just be the perfect launchpad.

Taught by the popular Udemy instructor Mohsen Hassan, this course has become a go-to resource for beginners and intermediate traders alike. With over 470,000 students enrolled, it’s earned its spot as one of the most widely taken stock trading courses on the platform.

Let’s break down what makes this course such a standout.

Instructor Reputation

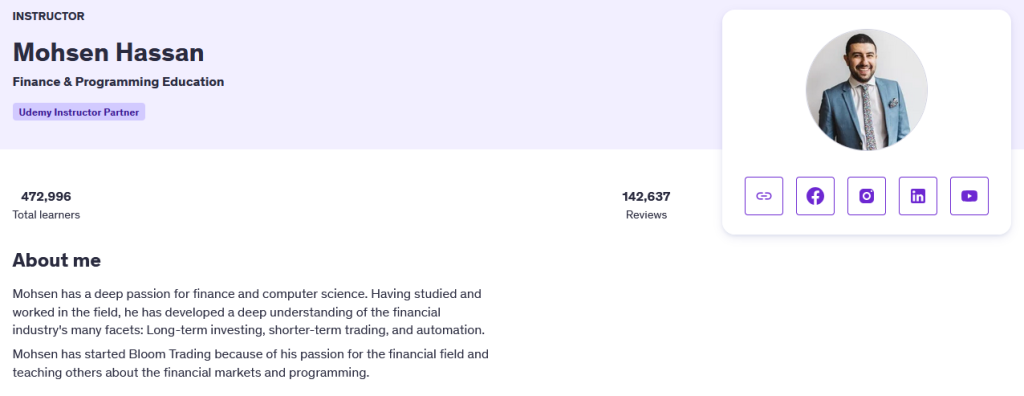

When it comes to online trading education, having the right teacher makes all the difference—and Mohsen Hassan is a name that consistently stands out on Udemy. With over 472,000 students enrolled and more than 140,000 reviews, Mohsen has built a reputation for being not just an educator, but a mentor to thousands of aspiring traders.

His background is a blend of finance and computer science, which gives his teaching a unique edge. He’s not just teaching from theory—he brings practical experience from both Wall Street-style analysis and the world of programming. This combination allows him to break down even the most technical trading topics in a way that’s digestible and structured, which is a big reason why this course appeals to both beginners and intermediate learners.

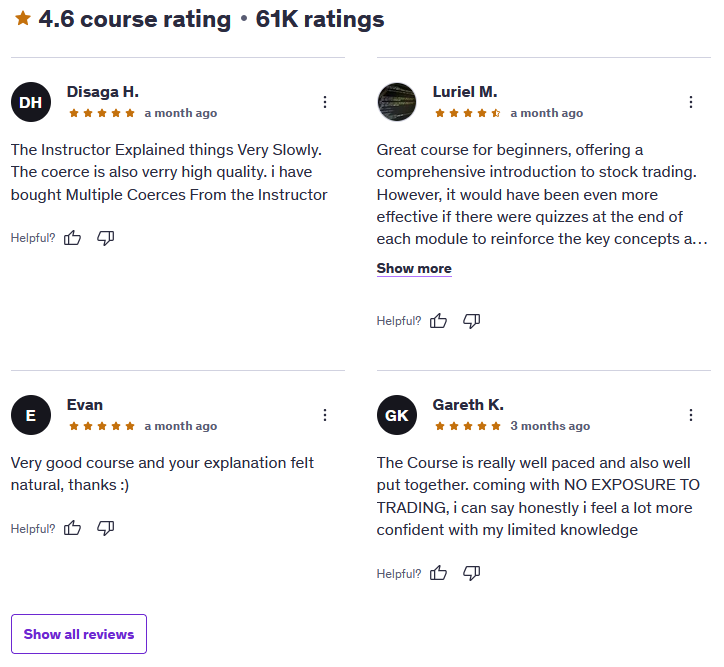

Beyond the stats, Mohsen’s style is calm, clear, and methodical. He doesn’t rush through concepts or assume prior knowledge, which makes his courses especially friendly to people starting from scratch. Many students have commented on how approachable and non-intimidating his tone is. One reviewer said it best: “Coming with no exposure to trading, I feel a lot more confident with my limited knowledge now.”

He’s also the founder of Bloom Trading, an educational initiative he created out of a genuine desire to help others succeed in the financial markets. It’s not hard to see that passion reflected in his courses. Whether it’s explaining how stock orders work or breaking down the psychology behind poor trading decisions, there’s a consistent effort to make things both understandable and actionable.

And while the praise is plentiful, Mohsen doesn’t rest on his laurels. He continues to update and refine his content, and actively engages with student feedback. One user suggested adding quizzes at the end of each section—and it wouldn’t be surprising if Mohsen takes that into account for future updates, considering his track record of responsiveness.

In short, Mohsen Hassan’s credibility, teaching clarity, and dedication to student success make him a standout instructor in the online finance space. Whether you’re a total beginner or someone looking to patch up knowledge gaps, you’re in good hands with this course.

Course Structure

One of the things that sets The Complete Foundation Stock Trading Course apart is how well it’s structured. This isn’t one of those chaotic, information-dump-style courses that leave you more confused than when you started. Instead, it’s carefully designed to walk you through trading step-by-step, starting from the absolute basics and gradually building toward more advanced strategies.

The course kicks off with a deep dive into the fundamentals—what the stock market is, how companies go public, and what it actually means to own a share of stock. Mohsen explains all the major players involved: brokers, exchanges (like the NYSE and NASDAQ), and the mechanics behind stock price movements. It’s the type of foundational knowledge that many new traders skip over, only to realize later how crucial it is.

From there, the course seamlessly transitions into order types and execution mechanics. You’ll learn what limit orders, market orders, and stop-losses are—and more importantly, how and when to use them. Mohsen also covers the ins and outs of different exchanges, and how trading on one may differ from trading on another (e.g., NYSE vs. AMEX).

Then comes the heart of the course: Technical Analysis. This section is comprehensive without being overwhelming. You’ll explore candlestick patterns, trend analysis, support and resistance levels, and trading indicators like RSI, Bollinger Bands, and ATR. The explanations are practical, and you’ll understand why each concept matters—not just how to spot it on a chart.

Another standout section is Risk Management and Money Management, which is too often neglected in other trading courses. Mohsen doesn’t just throw around buzzwords like “risk-reward ratio.” He teaches you how to calculate position size, set appropriate stop losses, and structure your trades so that even a series of losses won’t blow up your account. It’s clear that he understands long-term survival in the markets is just as important as short-term gains.

Perhaps most impressively, the course devotes a full section to Trading Psychology. This is where Mohsen really taps into the human side of trading—how emotions, fear, greed, and cognitive biases can derail even the best strategy. While a few students noted they’d love more real-world examples in this section, it’s still a valuable foundation that many trading courses don’t even touch.

Each topic builds logically on the one before, and the course avoids overwhelming learners with jargon or unfiltered data. Everything flows—so you’re not left wondering what to do with what you just learned. And while it doesn’t yet include quizzes or assignments, the clear explanations and structured layout make it easy to take notes and apply what you’ve learned.

In summary, the course structure is thoughtfully designed, progressively layered, and beginner-friendly—without sacrificing depth. Whether you’re starting from zero or have dabbled in trading before, you’ll likely walk away with a stronger grasp of the stock market and a clearer strategy for moving forward.

Content Quality

The content in The Complete Foundation Stock Trading Course is impressively rich, especially considering its beginner-friendly positioning. Mohsen Hassan has managed to strike a rare balance—he makes complex trading principles feel approachable, but he doesn’t dumb them down. Instead, he builds a solid educational bridge between the basics and more intermediate techniques, allowing learners to scale up their knowledge with confidence.

Each video is carefully scripted and intentionally paced. There’s no filler or unnecessary fluff—just clear, focused instruction that builds progressively. Visual learners will appreciate that the course includes plenty of screen recordings, chart walkthroughs, and order entry examples. Mohsen also incorporates charting platforms to demonstrate real-life technical analysis concepts, which helps connect the dots between theory and practice.

The Technical Analysis module is where the course really shines in terms of depth. Mohsen covers all the essentials—trendlines, chart patterns, candlestick formations, volume analysis, and key indicators. What’s refreshing is that he doesn’t just list out definitions; he explains how traders use these tools in real-time decision-making. His coverage of Bollinger Bands, RSI, and Average True Range (ATR) gives students the technical vocabulary needed to analyze charts intelligently—not just follow trade signals blindly.

But what sets this course apart from many others in the same category is its emphasis on Risk and Money Management. You’ll learn not just how to size your positions, but why it’s essential to do so. Mohsen introduces formulas and practical guidelines that students can actually use. He addresses real trading concerns, like “how much should I risk per trade?” or “how do I make sure I don’t blow up my account?” These are crucial topics, and the fact that they’re given such thoughtful attention shows just how comprehensive this course really is.

Another standout is the Trading Psychology section. Mohsen takes the time to discuss how emotions like fear, greed, and impatience influence decision-making. It’s not uncommon for traders to know the right moves technically, but fail emotionally. This section helps bridge that gap, offering frameworks for building discipline, staying objective, and sticking to a plan—even when the market tests you. While a few students felt that this area could be expanded with more real-life stories or case studies, it’s still a highly valuable component.

One minor limitation: interactivity is low. There aren’t any built-in quizzes, exercises, or trading simulators included. For some students, especially those who learn best through practice and repetition, this might feel like a missed opportunity. But in terms of pure educational content, the course remains top-tier.

All in all, the course provides an exceptionally well-rounded curriculum that combines technical mastery, strategic thinking, and emotional intelligence—all critical components of successful trading.

Overall Course Rating – 9/10

After spending time exploring every module, it’s clear why this course has earned such strong reviews on Udemy. With its depth, clarity, and instructor support, we’re giving The Complete Foundation Stock Trading Course a well-deserved 9 out of 10.

Right from the start, the course establishes itself as a highly structured and thoughtfully designed program. Whether you’re completely new to trading or you’ve opened a brokerage account but feel lost staring at a candlestick chart, this course gives you the tools, vocabulary, and mental framework to get oriented fast. It’s not a magic formula for quick riches (and thankfully, it never pretends to be)—but it is a thorough and grounded education that can form the basis of a lifelong trading practice.

The course’s greatest strengths are its comprehensive coverage and clear delivery. Mohsen’s teaching is calm, professional, and never condescending. You get the feeling that he genuinely wants his students to succeed, not just passively watch videos. His breakdown of technical analysis and trading psychology is some of the best we’ve seen at this level.

We also appreciate the strong focus on capital preservation—this is one of the few beginner-friendly courses that teaches you not just how to get into a trade, but how to protect your capital when things don’t go your way. This alone could save new traders hundreds (if not thousands) of dollars in losses.

So why not a perfect 10? Mainly because of the lack of interactive elements. Quizzes, module recaps, or even sample trades for review would go a long way in reinforcing what students have learned. Some students also suggested that the psychology section could include more real-world trading scenarios or emotional case studies to make the lessons feel more immediate and relatable.

Still, these are relatively minor gaps in an otherwise outstanding course.

Final verdict: if you’re serious about learning how to trade the stock market—and you want to do it in a responsible, structured, and skill-based way—this course is a fantastic place to start. Whether you want to be a day trader, swing trader, or simply a more informed investor, The Complete Foundation Stock Trading Course gives you a strong foundation that can support whatever direction you choose to grow in.