Whether you’re a real estate professional aiming to upskill or a career switcher dreaming of entering the high-stakes world of commercial real estate, The Real Estate Financial Modeling Bootcamp on Udemy makes a compelling pitch. Taught by industry veteran Justin Kivel, this course promises to take you from Excel amateur to modeling pro. Designed specifically for those looking to break into or level up in real estate private equity, it doesn’t just teach theory—it walks you through the real-world mechanics of modeling complex deals in Excel.

Let’s dig into whether this course really delivers on its ambitious goals.

Instructor Reputation

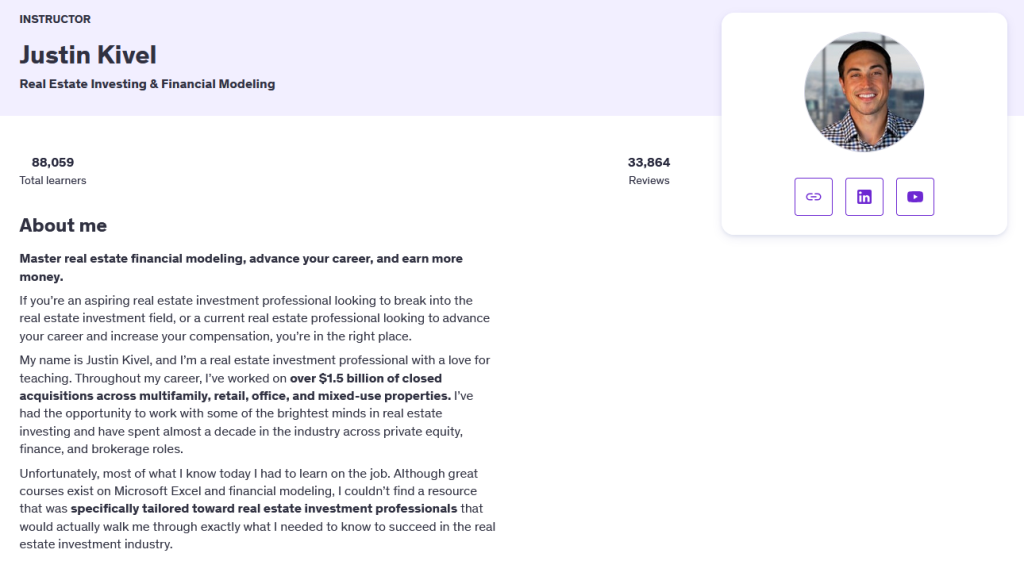

When it comes to learning a technical and industry-specific skill like real estate financial modeling, the credibility of the instructor can make or break the experience. Thankfully, Justin Kivel is the kind of instructor who immediately puts students at ease—not only because of his teaching style, but because of the depth of real-world experience he brings to the virtual classroom.

Justin isn’t just a passive educator or theorist. He has a proven track record in the real estate private equity space, having personally worked on more than $1.5 billion in closed commercial real estate transactions. That kind of résumé isn’t just impressive—it’s rare, especially among online instructors. His career spans across high-stakes domains like multifamily, office, retail, and mixed-use acquisitions, which means the examples and scenarios he introduces in the course are drawn directly from deals he’s actually worked on. This adds immense value for learners who want their training to reflect the kinds of challenges and calculations they’ll face on the job.

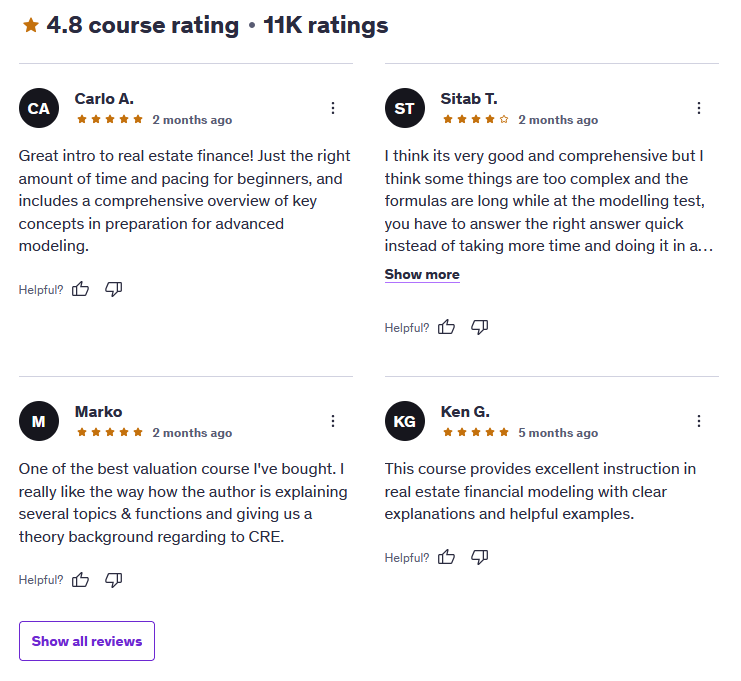

Beyond experience, Justin’s reputation on Udemy is stellar. He boasts a 4.8 out of 5 instructor rating, with tens of thousands of reviews and a growing student base that has surpassed 88,000 learners. Those aren’t just vanity metrics—they reflect consistent praise across multiple courses for his clear explanations, structured delivery, and real-world relevance. Students frequently mention how his guidance helped them secure interviews, land jobs, or improve their on-the-job performance, especially in roles related to acquisitions, asset management, and real estate finance.

Perhaps even more impressive is how accessible and responsive Justin is. According to multiple reviews, he actively engages with learners’ questions in the Q&A section, sometimes even going out of his way to offer career advice or help troubleshoot individual modeling challenges. This level of engagement is rare in large online courses, and it’s something students clearly appreciate.

In a world full of generic financial modeling content, Justin Kivel stands out as a niche expert who knows exactly what real estate professionals need to succeed—and he delivers it with precision, patience, and a passion for teaching.

Course Structure

One of the standout features of The Real Estate Financial Modeling Bootcamp is how thoughtfully it’s structured to take you from zero to proficient in the world of CRE (Commercial Real Estate) modeling. Whether you’re just starting out or brushing up your skills, the course is designed to scale with you—offering both solid fundamentals and complex, real-world modeling scenarios.

The course begins with a clear introduction to the objectives and a roadmap for what you’ll build over the coming hours. From there, it’s all about building a dynamic real estate financial model from scratch in Microsoft Excel. This isn’t a “watch and forget” experience—you’ll be actively following along, building your own spreadsheets and models in tandem with the lessons.

Each section of the course builds progressively. You start by getting comfortable with Excel shortcuts, layout formatting, and core formulas—especially those that are critical in real estate valuation and investment analysis. Then the course moves into more advanced territory, such as:

- Cash flow modeling across multi-year investment periods

- Capital expenditures and operating assumptions

- Building a pro forma

- Modeling for IRR (Internal Rate of Return), equity multiples, and cash-on-cash return

- Creating dynamic inputs and sensitivity tables for scenario analysis

- Structuring models for multiple asset types, including multifamily and mixed-use properties

One particularly strong feature of the structure is the hands-on nature of the course. You’re not just listening—you’re doing. And with the provided templates, spreadsheets, and exercises, you get to practice in the exact same format used by analysts and associates at top-tier real estate firms.

The pace of the course is intentionally measured. Justin explains even complex calculations in digestible chunks, so you’re not overwhelmed by multi-layered Excel formulas. The clarity in instruction helps students of varying experience levels feel like they can keep up, while the practical examples ensure you always understand how each part of the model connects to real investment decisions.

Another nice touch? The course includes career context at key moments—reminding you where specific skills show up in job interviews or on the job. It’s a subtle but helpful way of reinforcing the practical application of everything you’re learning.

In short, the structure of this course mirrors the workflow of an actual real estate modeling project. From raw data to final investment analysis, you learn to build something functional, credible, and presentation-ready. The logical flow, thoughtful scaffolding, and rich supporting materials make it easy to see why so many students walk away saying this was the best online course they’ve taken—not just in real estate, but period.

Content Quality

The content in The Real Estate Financial Modeling Bootcamp is dense, practical, and laser-focused on real-world application. From the first module to the last, there’s a consistent emphasis on teaching you the exact skills used by professionals in real estate private equity. Unlike some courses that dabble in broad finance theory or overwhelm students with irrelevant academic jargon, this course stays true to its core promise: learn by doing, and walk away with an actual modeling skill set.

One of the standout features of the course content is its realistic use cases. Justin doesn’t just show you how to build a model—he teaches you why each metric matters, how assumptions play into long-term investment outcomes, and where each concept fits within the broader context of a deal. For example, when he introduces IRR or cash-on-cash return, it’s not just a mathematical walkthrough—it’s framed within decision-making scenarios that mirror what you’d encounter in a real job or investment pitch.

The quality of the Excel training itself is top-tier. Many students praised the balance between finance and Excel skills, and it’s easy to see why. The lessons are structured to gradually level up your technical abilities. You start with keyboard shortcuts and formatting tips, then move toward more advanced techniques like circular references, data validation, dynamic range management, and multi-scenario modeling. The Excel workbooks provided with the course are thoughtfully organized and include all the relevant formulas, templates, and output structures needed to follow along efficiently.

Another major plus is how comprehensively the course addresses different asset types—a rarity in most real estate modeling courses online. Whether you’re modeling a multifamily acquisition or a mixed-use redevelopment, the course shows you how to adapt your frameworks accordingly. This cross-asset flexibility makes the content not only educational but highly adaptable for different job roles in CRE (Commercial Real Estate).

Students who come from a finance or accounting background will appreciate the course’s attention to industry-specific nuances, while those newer to real estate can feel reassured by how clearly each new concept is introduced. Even complex formulas are broken down into logical steps, with explanations for each cell and line item.

If there’s one critique, it’s that certain segments may feel a bit intense for beginners, especially if they don’t have prior experience with spreadsheets. But that’s also a testament to the depth and ambition of the course—it’s meant to train professionals, not just hobbyists. And with lifetime access and self-paced lessons, students have plenty of time to review the material multiple times.

Ultimately, the content quality here is well above average—polished, practical, and built for serious learners. You’re not getting fluff. You’re getting a true crash course in how CRE pros actually analyze and structure deals.

Overall Course Rating – 9.5/10

If you’re hunting for a course that will genuinely prepare you to model real estate investments like a private equity analyst, The Real Estate Financial Modeling Bootcamp scores an impressive 9.5 out of 10.

Right from the start, it’s clear that this course isn’t trying to impress you with buzzwords or surface-level overviews—it’s a deep dive into the nitty-gritty of real estate deal analysis. And more importantly, it’s teaching a replicable skill that has immediate ROI for your career or investing journey.

The production quality is solid, the downloadable materials are comprehensive, and the course flow is smooth. Each module builds upon the last in a way that feels intentional and logical. More than just a modeling course, this is a career accelerator for anyone hoping to transition into commercial real estate, land an analyst role, or improve their deal-making confidence as an investor.

Justin’s instruction style deserves another shout-out. He has a knack for making intimidating material feel manageable, and the level of real-world context he adds gives the course extra weight. Whether he’s referencing how institutional investors assess returns or how to frame assumptions in a pitch deck, there’s always a sense that you’re learning from someone who has actually done this at a high level.

The only minor drawbacks are things like the steep learning curve for those brand new to Excel or finance. A few students noted that some formulas or modeling sections might require extra review time. That said, these challenges are not due to poor course design—they’re a reflection of how robust and job-ready the content actually is.

Students regularly report back with real-life outcomes: landing analyst roles, acing Excel modeling tests in interviews, building their own CRE syndication models, and even outperforming traditional MBA coursework in terms of usefulness.

So whether you’re a college student eyeing a role in acquisitions, a property manager leveling up, or a solo investor looking to model your next deal with precision—this course more than delivers.