If you’ve ever wondered how multinational companies shift profits around the globe, or you’ve come across the phrase transfer pricing in the news but never really understood what it meant, this course is for you. Transfer Pricing Fundamentals is a beginner-friendly introduction that explains how companies handle cross-border transactions, why tax authorities care so much, and what the rules are that govern all of it. It’s not a deep dive into every technical nuance (transfer pricing is way too complex for that in just one course), but it’s a solid starting point for finance, accounting, and tax professionals who need a clear overview.

Instructor Reputation

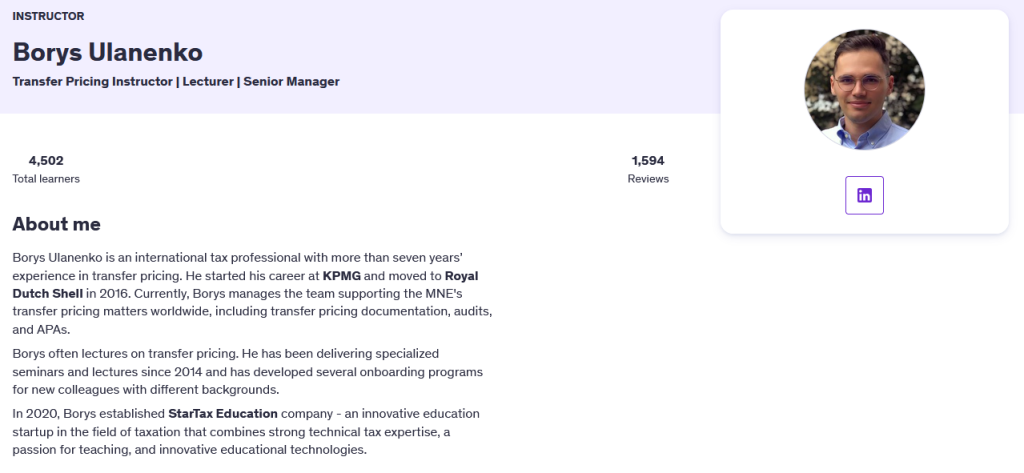

When it comes to technical topics like transfer pricing, the instructor’s background makes all the difference. And this is where Borys Ulanenko shines. He isn’t just a teacher who read a few books on tax rules — he’s a seasoned professional with years of hands-on experience in the field. Borys began his career at KPMG, one of the “Big Four” accounting firms, where he was exposed to a wide variety of transfer pricing cases across different industries. Later, he transitioned into an in-house role at Royal Dutch Shell, one of the largest multinational enterprises in the world, where he currently manages global transfer pricing matters. That role alone tells you he’s not working on theory — he’s navigating the same complexities multinationals face every day, from documentation requirements to tax audits and cross-border compliance.

On top of his professional track record, Borys also has an extensive teaching background. Since 2014, he has been running specialized seminars and onboarding programs designed to break down the complexities of transfer pricing for new colleagues and professionals. This teaching experience is evident in the way he presents the material. He knows which concepts beginners struggle with, and he explains them in plain terms without oversimplifying. His StarTax Education company further shows his commitment to spreading practical tax knowledge, blending his technical expertise with modern educational tools.

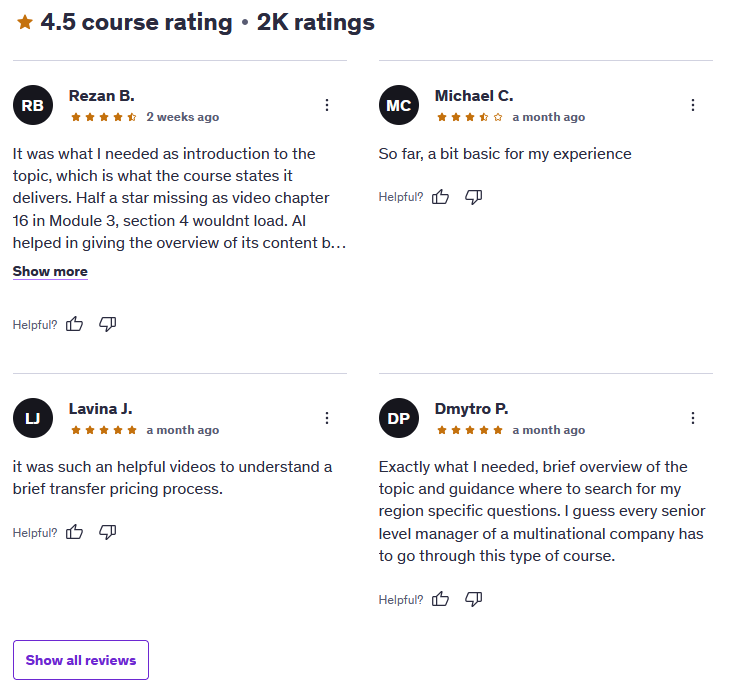

Reviews of the course consistently highlight that Borys delivers exactly what he promises — a clear, foundational overview of transfer pricing. Some students have mentioned that his English pronunciation takes a bit of adjusting to, but most agree that the clarity of his explanations and the structured delivery outweigh this minor challenge. The fact that he holds a 4.5-star instructor rating with over 1,500 reviews and has taught more than 4,500 students speaks volumes about his reliability and reputation in the online learning space. In short, you’re not just learning from an instructor — you’re learning from someone who actively practices what he teaches, which adds a lot of credibility to this course.

Course Structure

One of the strongest aspects of Transfer Pricing Fundamentals is how logically it’s structured. Transfer pricing is one of those topics that can feel overwhelming if you try to jump straight into methods or documentation without building a solid base. Borys avoids that pitfall by laying things out in a way that mirrors how professionals actually approach transfer pricing in practice.

The course kicks off with the basics of transfer pricing: what it is, why it matters, and which types of companies and transactions it applies to. This is crucial because before you can appreciate the complexity of the rules, you need to understand the fundamental concepts like multinational enterprises, intragroup transactions, and associated enterprises. From there, the course moves into the arm’s length principle, which is essentially the backbone of international transfer pricing rules. This part is explained step by step, including where the principle comes from and why tax authorities around the world rely on it.

Once the foundation is set, the course introduces students to comparability analysis and the five OECD comparability factors. These factors—things like contractual terms, functions performed, and risks assumed—are what make transfer pricing assessments more than just number-crunching. Borys takes the time to explain why each factor matters and how they interconnect, giving learners a framework for evaluating controlled transactions.

The course then moves into functional analysis and entity characterization, both of which are critical when trying to map out how value is created and who bears which risks in a multinational group. This leads into an overview of the five OECD transfer pricing methods, which are tools used to determine whether intercompany pricing is “at arm’s length.” By the time you get here, you already have the background needed to actually understand why one method might be better than another depending on the situation.

Finally, the course wraps up with an introduction to transfer pricing documentation. While this section doesn’t go into the weeds of country-specific requirements, it’s an important inclusion because documentation is where theory meets practice. It’s the part of transfer pricing that tax authorities demand and where companies have to prove their compliance.

Students generally like the flow of the course because it starts broad and narrows down into practical application, without overwhelming them at the start. Some have mentioned that they’d like more real-world examples or extended case studies, but most agree that for a fundamentals-level class, the structure is easy to follow and provides a strong launchpad for further learning.

Content Quality

When it comes to the actual content, Transfer Pricing Fundamentals strikes a balance between being approachable and still delivering technical accuracy. This is no easy feat because transfer pricing is one of those areas that’s filled with dense tax jargon, acronyms, and legal frameworks. Borys manages to cut through that by focusing on clarity first. Instead of overwhelming you with a flood of rules, he carefully layers the material, starting with “what is transfer pricing” and building toward complex ideas like comparability analysis and OECD methods.

The course content is also globally relevant. Transfer pricing is not a topic that changes drastically between countries—it’s based on international standards like the OECD guidelines. Borys makes sure to emphasize that the concepts taught apply worldwide, which is great for students who want to work in multinational companies or who collaborate with cross-border tax teams. This avoids the limitation of being tied to just one country’s laws.

Another strength is how the content stays focused on giving you the “big picture.” For example, when discussing the arm’s length principle, Borys doesn’t just say “this is what the rule is.” He explains why it exists, how it’s meant to prevent tax avoidance, and why it has become the cornerstone of transfer pricing rules globally. This contextual approach helps learners understand not just what the rules are, but why they matter.

That said, the course is not without its limitations. A few students have pointed out that while the theory is well-explained, the content would be even stronger with more practical examples and case studies. For instance, walking through a mock intercompany transaction and showing how you would apply each OECD method would really bring the concepts to life. Similarly, a deeper dive into how documentation looks in practice—maybe even a sample transfer pricing report—would give learners a more hands-on feel.

Another area where the course could improve is in length. Some reviewers felt that the lessons are a bit on the shorter side, and they wanted more depth in certain modules. For an introduction, brevity can be a strength, but for professionals who plan to actively work with transfer pricing, more detail could provide extra value.

Overall, though, the content is solid, accurate, and reliable. It’s clear that the course has been carefully put together to provide learners with the fundamental building blocks of transfer pricing without burying them under hundreds of pages of regulations. If you’re a beginner, you’ll walk away with a strong understanding of the subject. If you’re already working in finance or tax, you’ll get a useful refresher and a clear framework that you can build on with more advanced materials.

Overall Course Rating – 9.5/10

If I had to give Transfer Pricing Fundamentals a score, I’d confidently place it at a 8.5 out of 10. That rating feels fair because it strikes a nice balance: it delivers on its promise of being an accessible introduction, while also leaving room for improvement in terms of depth and practical application. In other words, it’s not perfect, but it’s definitely a strong choice for anyone curious about or working around transfer pricing.

What really boosts the rating is the instructor’s credibility and teaching style. Having someone who has lived and breathed transfer pricing in both consulting (KPMG) and in-house corporate environments (Shell) gives the course weight. You know you’re learning from someone who’s dealt with the exact kinds of challenges multinationals face when tax authorities come knocking. That professional background makes the explanations more trustworthy than if they were coming from a purely academic source.

Another reason the course scores high is its clarity of explanation. Transfer pricing is notoriously complex, and yet Borys has managed to simplify the fundamentals into bite-sized lessons that make sense. The fact that reviewers often say “this gave me the overview I needed” shows that the content is well-aligned with expectations. You don’t walk away confused — you walk away with the vocabulary and framework needed to understand how transfer pricing fits into the bigger tax and finance picture.

The downsides, while worth noting, don’t drag the course down too much. The biggest ones are the lack of detailed real-world case studies and the relatively short runtime. Some learners also mentioned the English pronunciation could be smoother. These are areas that could be improved in a future version of the course, perhaps by adding more modules or including interactive exercises.

At the end of the day, though, Transfer Pricing Fundamentals does exactly what it sets out to do: it gives you a strong introduction to an otherwise daunting subject. For finance professionals, accountants, or tax specialists who need to get comfortable with transfer pricing concepts, this course is well worth the time and cost. It’s not the last course you’ll ever need on the topic, but it’s a very strong first step.