Diving into the world of real estate and mortgages can be as daunting as navigating a labyrinth. But, the “U.S. Residential Real Estate, Property & Mortgage Business” course on Udemy, designed and delivered by the Starweaver Instructor Team, aims to be your trusty guide. Here’s a casual stroll through what the course offers, its structure, and my take on its content quality and overall rating.

Imagine a course that doesn’t just teach you the ropes but immerses you in the vast sea of the U.S. residential real estate market, valued at a staggering $8.5 trillion. This course promises a comprehensive dive into the mortgage market’s intricacies, from property financing and mortgage underwriting to financial analysis and operations. It’s like being handed the keys to a secret library where every book unveils another layer of the real estate world.

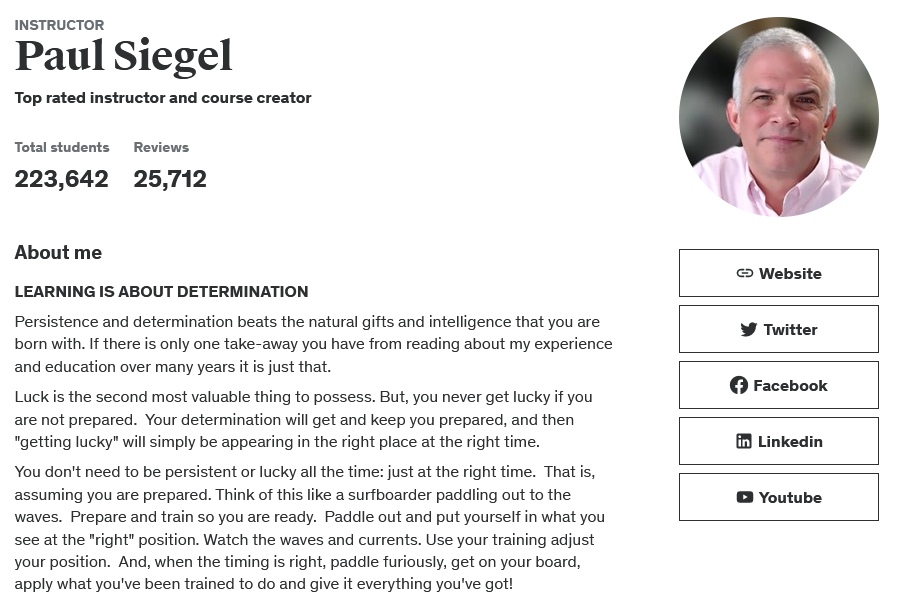

Instructor Reputation: The Pillars of Knowledge

In the realm of online learning, the caliber of instructors can make or break a course. The “U.S. Residential Real Estate, Property & Mortgage Business” course shines brightly in this aspect, thanks to the formidable duo of Paul Siegel and Russ Faulkner. Their credentials are not just impressive on paper; they bring a wealth of real-world experience and insights that enrich the course content beyond the conventional curriculum.

Paul Siegel, one of the masterminds behind this course, is a titan in the field of investment banking with a focus on real estate. His involvement in the financing of over $1 billion worth of real property in the U.S. is not just a testament to his expertise but also to his deep understanding of the nuances of real estate financing and investment. In a market as volatile and complex as real estate, having guidance from someone who has navigated through its highs and lows is invaluable. Paul’s experience offers students a rare glimpse into the strategic decision-making processes and financial acumen required to thrive in the industry.

On the other side, we have Russ Faulkner, whose background in delivering top-notch training at one of the largest global banks complements Paul’s expertise perfectly. Russ’s experience in education and training, especially within the banking sector, equips him with the unique ability to distill complex concepts into digestible, engaging lessons. His approach to teaching reflects a deep understanding of the need for practical, real-world applications of theoretical knowledge. Together, Paul and Russ form a teaching powerhouse, combining the strategic, financial, and educational aspects of real estate and mortgage business into a coherent, comprehensive learning experience.

The reputation of these instructors adds a layer of credibility and reliability to the course. It’s not just about learning from experts; it’s about absorbing the wisdom that can only be gleaned from years of experience in the trenches. For prospective students, knowing that the course is led by individuals who have not only studied the field but have also shaped it with their contributions, adds a level of assurance and motivation to engage with the material.

Course Structure: A Blueprint for Mastery

Diving into the structure of the “U.S. Residential Real Estate, Property & Mortgage Business” course is akin to exploring a well-designed architectural masterpiece. The course is meticulously structured to ensure a logical progression of topics, making complex concepts accessible and engaging for students at all levels. With nearly 30 modules spread across three main sections, the course layout is both comprehensive and focused, providing a 360-degree view of the residential real estate and mortgage business.

Foundational Knowledge

The journey begins with the “U.S. Residential Mortgage Business and Process Fundamentals” section, designed to ground students in the basics. This foundation is crucial for building a solid understanding of the industry’s landscape. It covers the critical players, key terminologies, and the consumer buying cycle, ensuring that students are well-equipped to delve deeper into the subject matter. This section acts as the cornerstone of the course, setting the stage for more advanced topics.

Analytical Deep Dive

Following the foundational knowledge, the course transitions into the “U.S. Residential Mortgage Analysis: Bringing It All Together” section. This part of the course is where the real magic happens. Students are taken on a deep dive into the analytical aspects of the mortgage business, including financial and credit underwriting, mortgage types, and risk assessment. The modules are designed to not only provide theoretical knowledge but also to hone the analytical skills necessary for real-world applications. This section is the heart of the course, where students start to connect the dots between theory and practice.

Practical Applications and Beyond

The final section, “Loan Management, Servicing and Securitization,” focuses on the practical applications of the concepts learned in the previous sections. It covers the lifecycle of a mortgage, from origination and servicing to securitization, offering a comprehensive overview of the process. This part of the course is particularly valuable for students interested in the operational aspects of the mortgage industry. It provides insights into the challenges and opportunities in loan management and the complexities of the securitization process.

Each module within these sections is supported by videos and accompanying PDFs, ensuring that students have access to a variety of learning materials. This multi-modal approach caters to different learning styles, enhancing the overall educational experience. The course’s structure is not just about imparting knowledge; it’s about facilitating a journey of discovery and mastery, guiding students through the intricacies of the real estate and mortgage business with clarity and purpose.

In conclusion, the structure of this course reflects a thoughtful approach to learning, designed to engage, enlighten, and empower students. It’s a structured yet flexible framework that allows for deep exploration of topics while providing the tools and insights needed to apply this knowledge in real-world scenarios. Whether you’re a novice looking to get your feet wet or a seasoned professional aiming to deepen your expertise, this course offers a roadmap to mastery in the complex world of residential real estate and mortgages.

Content Quality: A Deep Dive into Excellence

The “U.S. Residential Real Estate, Property & Mortgage Business” course on Udemy offers a content quality that is nothing short of a gold mine for those eager to navigate the complexities of the real estate and mortgage industry. The curriculum, designed by seasoned professionals Paul Siegel and Russ Faulkner, is both exhaustive and insightful, providing learners with a comprehensive understanding of the subject matter. The course meticulously covers a broad spectrum of topics, from the basics of the mortgage market to the intricacies of financial analysis and mortgage operations, ensuring a well-rounded educational experience.

Richness in Content

The course stands out for its depth and breadth of content. It offers a detailed exploration of the U.S. residential real estate market, discussing everything from property financing and mortgage underwriting to the roles of key players in the industry. The modules are packed with information that is crucial for anyone looking to make a mark in the real estate sector, offering insights into the size and scope of the market, the various mortgage types, and the audiences for each. The course does an exceptional job of breaking down complex topics such as mortgage regulations, financial distress, and securitization, making them accessible to learners with different levels of expertise.

Practicality and Application

What sets this course apart is its emphasis on practical application. The inclusion of real-life examples, financial analysis tools, and case studies enhances the learning experience, bridging the gap between theoretical knowledge and real-world application. Students are not just passive recipients of information; they are encouraged to engage with the material actively, applying what they learn to conduct borrower income analyses, evaluate creditworthiness, and understand the mortgage securitization process. This hands-on approach is invaluable in preparing students for the challenges and opportunities they will encounter in their professional lives.

Engagement and Accessibility

Despite its comprehensive coverage, the course is designed to be engaging and accessible. The video presentations, accompanied by PDFs of each slide, cater to visual and textual learners alike. However, some students have noted that the presentation style could benefit from a more personal touch to enhance engagement. The narrated presentations, while informative, sometimes lack the warmth and connection that come from a more interactive teaching style. This feedback highlights an area for potential improvement in making the course content not just informative but also more relatable and engaging.

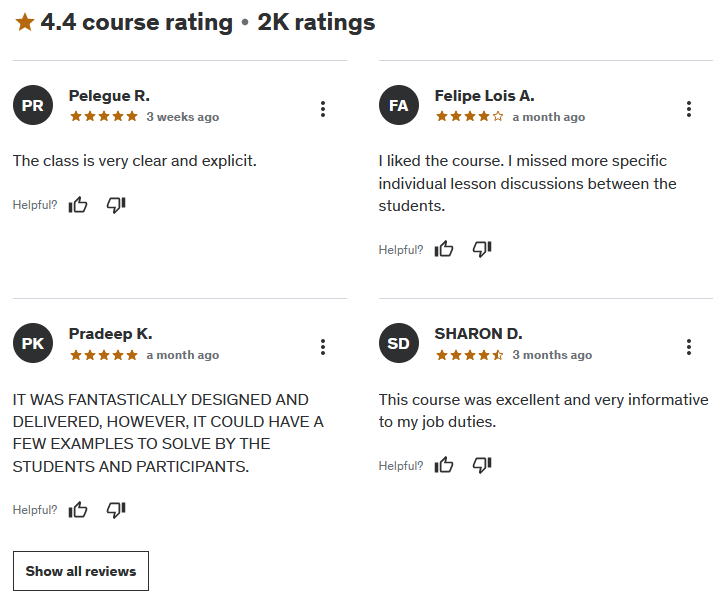

Overall Course Rating: 8.5/10

Considering the depth of content, the expertise of the instructors, the practical application of knowledge, and the slight room for improvement in engagement, I would rate the “U.S. Residential Real Estate, Property & Mortgage Business” course a solid 8.5 out of 10.

Strengths

- Expertise of Instructors: The course benefits significantly from the real-world experience and professional background of its instructors, adding depth and credibility to the content.

- Comprehensive Curriculum: With nearly 30 modules covering a wide range of topics, the course offers an unparalleled breadth of knowledge in the field of residential real estate and mortgages.

- Practical Application: The emphasis on real-world examples and practical application of concepts ensures that students are well-equipped to apply what they learn in professional settings.

Areas for Improvement

- Engagement: While the content is rich and informative, enhancing the delivery to make it more engaging and interactive could improve the learning experience. Personal anecdotes, interactive quizzes, and more dynamic presentations could help in this regard.

- Content Update: Some students have mentioned the need for updating course data to reflect the latest trends and changes in the industry, ensuring that the course remains relevant and up-to-date.

Overall, this course is a treasure trove of knowledge for anyone interested in the intricacies of the real estate and mortgage industry. Its comprehensive coverage, combined with the practical application of concepts, makes it a standout option for learners at all levels. While there is always room for enhancement, particularly in terms of engagement and content updates, the course undoubtedly offers valuable insights and knowledge, positioning it as a key resource for aspiring and seasoned professionals alike. This course is a beacon for those seeking to navigate the complex waters of the real estate and mortgage markets, offering the tools and knowledge necessary to sail towards success.