If you’ve ever stared at financial news wondering what exactly is going on behind the scenes at banks, or how financial markets really function—this Udemy course might be the perfect crash course for you. Understand Banks & Financial Markets is a compact yet insightful course that aims to make sense of the money world without requiring a finance degree. Let’s dive in.

Instructor Reputation

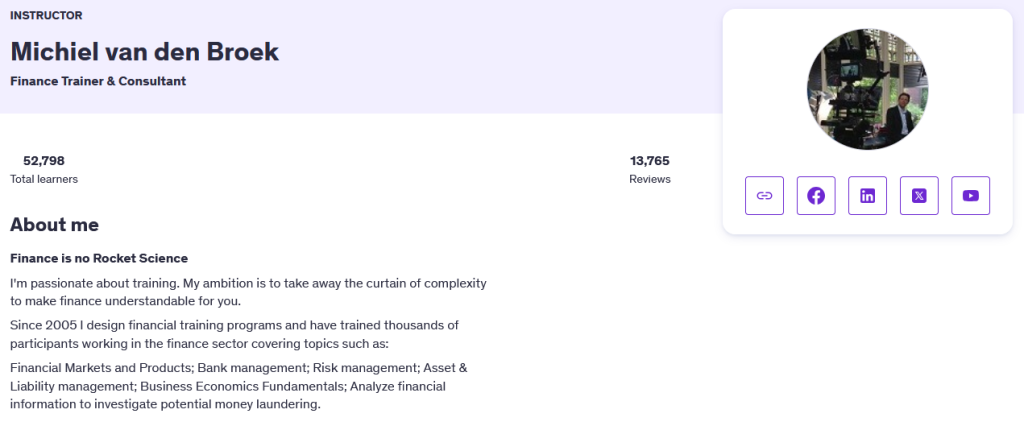

One of the standout aspects of Understand Banks & Financial Markets is the instructor behind it—Michiel van den Broek—a seasoned finance trainer and consultant with nearly two decades of teaching experience. His credentials are rooted not in academic ivory towers but in real-world banking, risk management, and financial consulting, which makes his teaching practical and grounded.

Michiel has been designing financial training programs since 2005, helping bridge the gap between complex financial systems and everyday professionals who may not have a traditional finance background. This course, like his others, is aimed specifically at making finance “understandable and accessible”, a mission he seems to take seriously. His philosophy—“Finance is no Rocket Science”—isn’t just a tagline, it’s the foundation of his teaching style.

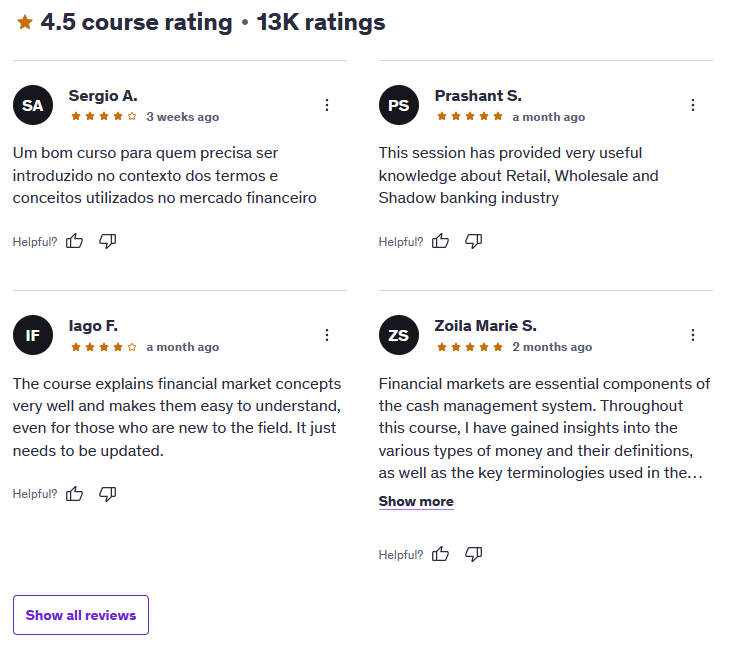

Across his five Udemy courses, Michiel has amassed over 52,000 students and received more than 13,000 reviews, with a consistently high 4.5-star rating. That kind of feedback doesn’t come easy on a platform filled with seasoned instructors and fierce competition. What students seem to appreciate most is his ability to simplify dense material without dumbing it down. He uses plain language, relatable analogies, and visual explanations to clarify things like derivative markets, capital flows, and central banking—all of which can otherwise seem like arcane subjects.

Even more impressively, Michiel’s content is trusted by professionals in diverse roles across the financial industry—from IT consultants and accountants to legal advisors and business analysts. His courses have found a strong following among learners who interact with finance peripherally but need to “speak the language” more fluently. This broader applicability has made his teaching a favorite among professionals looking to upskill or prepare for certifications such as GARP or ACI.

Students in this particular course also highlighted his clarity, enthusiasm, and real-world framing of abstract concepts. Some minor criticisms were aimed at the course captions and lack of quizzes, but overall, Michiel is clearly someone who knows his stuff and knows how to teach it.

Course Structure

At first glance, a 2-hour video course might seem too brief to cover the sprawling landscape of banking and financial markets—but don’t let the runtime fool you. Understand Banks & Financial Markets is structured with precision, offering a wide-angle lens on a notoriously complex field while keeping the content easy to digest.

The course is segmented into bite-sized video lectures, each focusing on a specific component of the financial system. This modular structure allows learners to progress at their own pace and revisit challenging topics as needed. Michiel wastes no time with fluff—each section is purposefully crafted to build on the last. You’ll start with the basics, like understanding the three types of money and how banks create money, before moving into the more intricate workings of capital markets, derivatives, and central banking policies.

The structure flows logically—from foundational concepts to market mechanisms to systemic risks. Along the way, the course introduces learners to core financial products like bonds, equities, swaps, and foreign exchange instruments, all explained in context. For those unfamiliar with how financial products are traded or who trades them (and why), this course provides a concise but powerful overview.

There are also specialty segments that touch on historical context, such as a breakdown of the 2008 financial crisis, and even a short animated history of the Amsterdam Stock Exchange—a unique, entertaining inclusion that adds both color and insight into how markets have evolved over centuries.

Another strong feature of the course is the inclusion of PDF resources and a downloadable 40-page book that complements the video lessons. These materials provide valuable reinforcement and give learners a chance to study key concepts offline. While the lack of in-lesson quizzes or exercises is a missed opportunity for some, the course still manages to convey a lot of information in a clear and structured way.

And it doesn’t end with this course. Michiel also offers follow-up content for those who want to go deeper into niche areas like financial risk and money markets, giving learners a natural path to continue their journey.

All in all, the course structure is ideal for beginners or professionals needing a high-level refresher. It’s designed for efficiency, but it doesn’t sacrifice depth, making it a solid investment of two hours.

Content Quality

The strength of Understand Banks & Financial Markets lies in how well it distills complex financial concepts into digestible, engaging content. Designed with non-finance professionals in mind, this course strips away the intimidating jargon that typically accompanies financial education and replaces it with real-world examples, simple language, and helpful visuals.

Right from the first lesson, it’s clear that the course is built with a progressive learning curve. It doesn’t assume any prior knowledge—something that’s often promised but rarely delivered in finance courses. You begin with foundational elements such as the three types of money, how banks operate, and the role of central banks, then gradually move toward more intricate topics like interest rate swaps, currency markets, and risk management. Each topic is introduced with context, explained with clarity, and connected to broader financial systems, which helps learners develop a more holistic understanding.

One particularly thoughtful inclusion is the segment on the 2008 financial crisis. Michiel explains not just what happened, but why it happened, who was involved, and what lessons can be learned from it. This section alone adds substantial value, as it connects financial theory to real-world consequences—a crucial step for truly understanding systemic risk.

The content is also visually enriched. The animations and slide-based explanations help reinforce core ideas and are especially useful for visual learners. Additionally, the downloadable 40-page book acts as a valuable offline companion, allowing students to revisit and review the course material at their own pace.

Still, the course isn’t without its limitations. Several students mentioned that the captions are occasionally inaccurate and that the absence of interactive elements, such as quizzes or knowledge checks after each section, slightly diminishes the learning experience. Incorporating short assessments or even reflection prompts could help learners consolidate their understanding and feel more engaged throughout.

Another small critique is that while the content is wide-ranging, some learners wished for more case studies or industry examples to tie abstract concepts back to daily life in a bank, investment firm, or corporate environment. Nonetheless, the core content remains well-structured and insight-rich.

Whether you’re a complete novice or someone who works adjacent to finance (think: IT, HR, compliance, legal), the course offers a solid knowledge foundation that you can build on. It’s clear, it’s relevant, and it’s impressively comprehensive for its length.

Overall Course Rating – 8.7/10

Taking all factors into account—from the clarity of the instruction to the depth of the content and the real-world relevance—Understand Banks & Financial Markets earns a well-deserved 8.7 out of 10. While not perfect, it strikes an impressive balance between accessibility and substance, making it one of the more effective entry-level courses in the finance category on Udemy.

One of the most commendable aspects of this course is its practical orientation. You don’t just learn theory; you learn why things matter and how they connect to the global financial system. The course’s modular structure allows for flexible learning, and the companion PDF book is a real bonus, especially for those who appreciate having tangible notes.

Michiel’s teaching style is consistently clear and direct. He has an obvious passion for demystifying finance, and his tone throughout the course is both encouraging and informative. Students are never made to feel behind or lost—even during topics like derivatives and yield curves, which can quickly become overwhelming in traditional finance classes.

Of course, there’s room for improvement. The addition of section-end quizzes, a glossary of key terms, and better transcript/caption support would elevate the course from great to excellent. For learners who thrive on interactivity or test-based reinforcement, this could be a bit of a drawback.

Still, the course has a clear sense of purpose and fulfills that purpose exceptionally well. It’s ideal for people entering finance-adjacent roles or those preparing for more advanced study or certification. It’s also a great refresher for professionals who want to reconnect with financial fundamentals without getting bogged down in technical minutiae.

If you’re looking for a straightforward, jargon-free introduction to how banks and financial markets actually work, this course delivers. It’s efficient without being shallow, and informative without being overwhelming. You’ll walk away with a clearer understanding of not just what banks do, but why it matters—and that makes it a worthy investment of your time.